About Us

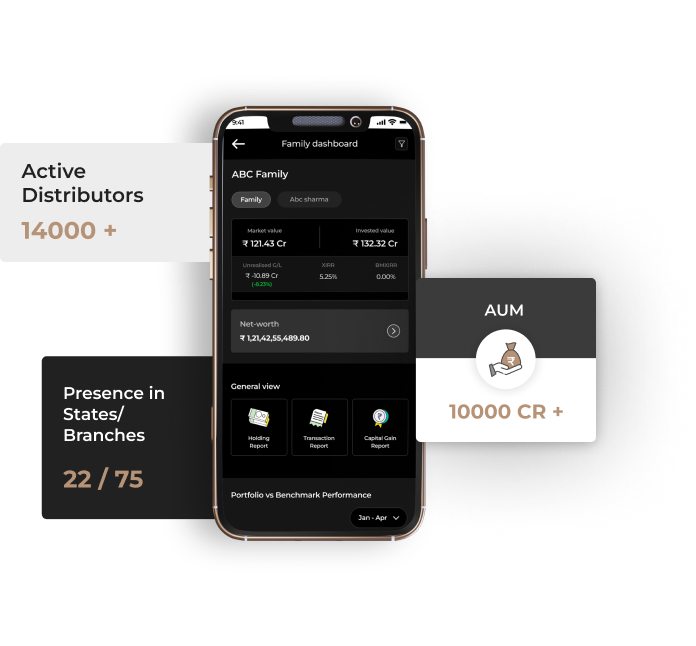

Established in 2022, Centricity offers a simple, cost-effective and transparent technology-enabled platform that helps investment professionals manage their client portfolios better. As private wealth management professionals with decades of experience behind us, we have deep insights into the challenges faced by wealth managers, their clients, and asset managers. It is our endeavour to empower these three stakeholders using technology in order for them to achieve better outcomes.

To be a technology and product partner of choice for all independent financial advisors and distributors!

We believe that there is a fundamental need to empower IFAs/MFDs in India so that investors achieve better outcomes. Centricity handholds financial services professionals to engage their clients efficiently.

Partner with Centricity’s OneDigital

India’s fastest growing B2B financial distribution Platform.

Financial Products

A financial product is an investment or security that provides buyers and sellers with a financial gain.

Equity Funds are mutual fund schemes which invest their assets in stocks of different companies based on the investment objective of the underlying scheme. These funds are a great investment option for capital appreciation as they can create long-term wealth.

Unlisted shares are private equity shares that are not listed on any stock exchange. They are owned by a smaller group of investors, including founders, early-stage investors & employees. They are not traded publicly but are bought and sold in the over-the-counter market. Additionally, they are not subject to the same regulatory requirements & obligations. By investing in unlisted, investors get greater control & influence over the company.

PMS is a professional financial service in which skilled, qualified & experienced fund managers & professionals manage equity or debt portfolios to achieve specific objectives. As per SEBI regulation, the minimum investment ticket for investing in PMS is Rs. 50 lakhs.

A debt bond is a type of investment where you lend money to a company or government in exchange for regular interest payments and return of the principal amount for a specific period.

Alternate Investment Funds are funds established in India as a privately pooled investment vehicle to collect funds from sophisticated investors. AIFs invest in listed & unlisted asset classes but are more focused on investing in instruments other than asset classes such as equity & debt. The minimum investment required is 1crores!

Corporate FD is a term deposit held over a fixed period at fixed interest rates. Company Fixed Deposits are offered by Financial and Non-Banking financial companies (NBFCs). The maturities of various company fixed deposits can range from a few months to a few years.

Tools & Calculators

What is the appropriate amount you should invest monthly or annually to reach your financial goals? With our calculator, you can determine how much to invest!

Select your calculator

Learn From Experts

PARTNER TESTIMONIALS

BLOGS

We cover an array of topics with simple explanations of multiple products!

Video

From NISM VA tutorials to PMS tutorials, we have you covered!

Meet Our Team

Founders: Why Us? Deep domain expertise in Private Wealth Management is OUR BIGGEST MOAT!

Manu Awasthy

Founder & CEO

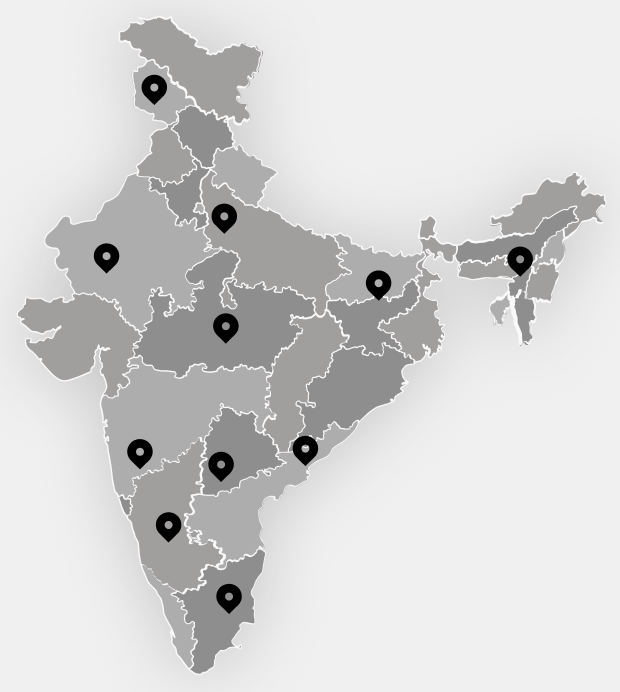

Centricity OneDigital’s presence across India

Cherished by every corner of India

FAQs

The Indian mutual fund industry is currently worth more than Rs. 55 lakh cr AUM as on 30th Apr’24. It is the fastest growing financial Industry with close to 20 % of Growth rate over the last 5 years. Out of 135 Crore Indians, only 3.25 crore individuals are currently investing in MF. That is less than 2% of our population. This shows high potential in the industry. Every month, around 8–10 lakh new investors join the mutual fund industry. PMS industry has an AUM of approximately INR 32 lakh Cr. including both equity and debt strategies, as of February 29th, 2024. AIF industry is currently worth close to INR 11 lakhs Cr. of AUM as on 31st Dec’23. P2P industry currently manages close to INR 8000 Cr. of AUM. Bonds (corporates) outstanding issuances on Mar’24 stands at INR 47.3 lakhs Cr. Despite the growth in MF investors, there is still a long way to go as

1. We still have an under-penetrated mutual fund market as compared to the developed world - AUM to GDP Ratio - India - 12% Vs World Average - 63%. Penetration of other investment products and financial products is even lower.

2. Low Competition : Only 1.26 lakh Mutual fund distributors Vs 20 lakh + Insurance advisors

3. Over the next decade, about 100 Lac Cr. of AUM opportunity is expected. The huge gap between demand and supply creates great career opportunities for you.

The essence of the financial products/investment products distribution business is the “recurring” or "trail commission." This commission is quite unique in nature and the payout here is done on a monthly/quarterly basis.

The two biggest advantages of this commission are that, firstly, it's calculated on the market value of the investment and, secondly, one gets the commission as long as the client is holding onto his investment in the market. Another unique feature which sets it apart from other financial products is the Power of compounding, this factor helps in growing your earnings exponentially.

So, for an example, if you are managing client investments of around Rs. 10 Crore and trail rate is 0.60%, you get a monthly trail income of Rs. 50,000. This income will increase based on movement of stock market and new business brought by you.

LETS UNDERSTAND EARNING WITH EXAMPLE

| YEAR | AUM GROWTH | TRAIL | CUMULATIVE INCOME |

| 1 | 1,15,000 | 805 | 805 |

| 2 | 1,32,250 | 926 | 1731 |

| 3 | 1,52,088 | 1065 | 2795 |

| 5 | 2,01,136 | 1408 | 5,428 |

| 10 | 4,04,556 | 2832 | 16,344 |

| 15 | 8,13,706 | 5696 | 38,302 |

Assume: Market Growth - 15%, Trail - 0.70%

There is no limitation on the number of attempts in an exam.

For becoming a Mutual Fund distributor:

Zero Investment requirement.

For Existing Mutual Fund Distributors (ARN Holder) :

Zero Investment requirement.

Centricity’s OneDigital provides you with online study materials like online training, study materials, self-online learning videos, mock tests, and revision sessions, etc. to clear the NISM Mutual Fund VA/21A Exam. You need to study at least 1 hour a day for a week to clear the exam.

After clearing the NISM Mutual Fund VA Exam you need to apply for an ARN license to CAMS and pay the requisite fees to CAMS. The Centricity OneDigital team will assist you in ARN application process. Similarly, one needs to clear NISM 21A exam for PMS distribution business. Alternatively, one may conduct this business through Centricity OneDigital platform.

If you want to distribute mutual funds and you're a non-ARN Holder, then it mostly depends on how much time you take to prepare for the NISM exam. But if you clear the exam within two weeks, then you can start your business before the third-week ends. If you are an ARN Holder, you can start mutual fund distribution after 24 hours of your registration with OneDigital Centricity.

For other products such as:

Bonds, P2P, PMS, AIF and Unlisted equities, one can commence distribution business immediately.

1. The exam has a total of 100 questions of 1 mark each.

2. Passing marks are 50.

3. There is no negative marking.

4. A person should be at least 18 years of age to appear for this exam.

No there is no annual or other type of membership fee with Centricity OneDigital.

Key reasons to associate with us:

1. India's fastest-growing financial product distributor, managing more than Rs.3,200 Cr of investor wealth.

2. There are more than 2,600 successful Financial product distributors (FPDs) associated with OneDigital Centricity in the country.

3. Opportunity to sell a wide range of products to your clients like mutual funds, Stocks, Bonds, PMS, AIF, Unlisted equity stocks, P2P products etc.

4. 360 Degrees in business development support like Dedicated sales manager to grow your business, marketing and sales support, Research Support, Best technology support for you and your clients, Training and development, Customer care support etc.

OneDigital Centricity is going to give you comprehensive 360-degree business development support. Business development supports like Dedicated Sales manager (One contact point), training & Development, sales support, marketing support, Technology Support, Research support, query solving support etc to enhance your business. Centricity OneDigital RMs will do joint calls with you.

You can invite your clients to online client meets with industry veterans. You will get access to multiple training sessions at OneDigital Centricity to enhance your knowledge and sales skills.

Yes. Our platform is completely online, hence OneDigital partners can acquire clients across the globe. So, whether it's your classmate in Kanpur or a relative in Chennai or an ex-colleague in Baroda, you can generate business from all of them online, sitting in your hometown.

OneDigital training team does digital sessions on investor awareness regularly with industry leaders for your potential clients too.

Centricity OneDigital partners get a very competitive commission rate. There is complete transparency in commissions with respect to mutual funds, PMS, AIF, bonds, P2P, unlisted equity etc.

Centricity OneDigital partners also get more benefits under privilege categories like Silver, Gold, Platinum, etc. As your Asset size grows, your category keeps upgrading automatically and with category upgrades your brokerage rates automatically get revised upwards.

All brokerages paid are exclusive of GST. If the partner is registered in GST, he can submit the invoice to us, and the GST amount is reimbursed back to the partner.

Above 18 Years.

Yes, that is possible. You need to follow the ARN change process.

You can start this business as a part-time business along with your job or business, and once you start earning a good commission from the financial product distribution business, you can start full-time according to your choice, but you need to give sufficient time to enhance your knowledge and meet your clients to grow your business.

There will be No Target for the business, but we are expecting you to do a decent business and also attend regular meetings & training to enhance your knowledge and do business regularly.

Your dedicated relationship manager will follow up regularly to keep you motivated and help you earn a good amount through this business. We expect you to devote 2-3 hours per day, minimum, to develop this business.

Drop us a message on the WhatsApp icon on the website page. Our team will contact and facilitate the onboarding.

Centricity was founded in 2022 by a team of wealth management professionals with a combined experience of more than 100 years! It is backed by some leading investors such as Burman family office. Today it is the fastest growing B2B2C wealth management company in India.