Are you investing in SIPs smartly ?

21st January 2025 | Author : Centricity

Today, investments are the 'new trend' in a world of fast-growing social media. There is a radical shift in investment approaches in India due to the emergence of GenZs & millennials who are constantly evolving their financial behaviours.

It was found that 93% of young adults consistently save money, setting aside 20-30% of their monthly income for future financial goals, according to a survey conducted by Nielsen titled The Fin One: Young Indians' Saving Habits Outlook 2024.

Thus, SIPs have become the new favourite among the investors!

Did you know that as per Times of India, the surge in SIP accounts has exceeded 10 crores, along with a record monthly contribution of Rs. 25,323 crore?

Amazing isn’t it?

SIPs are a great way to grow your money, but there is an even smarter way to enhance your investment!

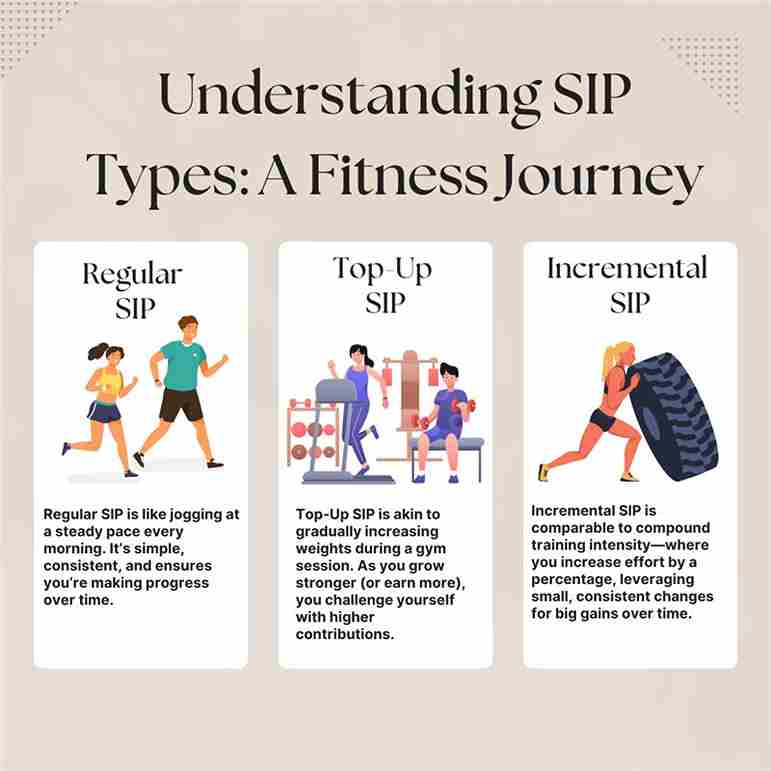

1. Regular SIP: The Steady Jogger

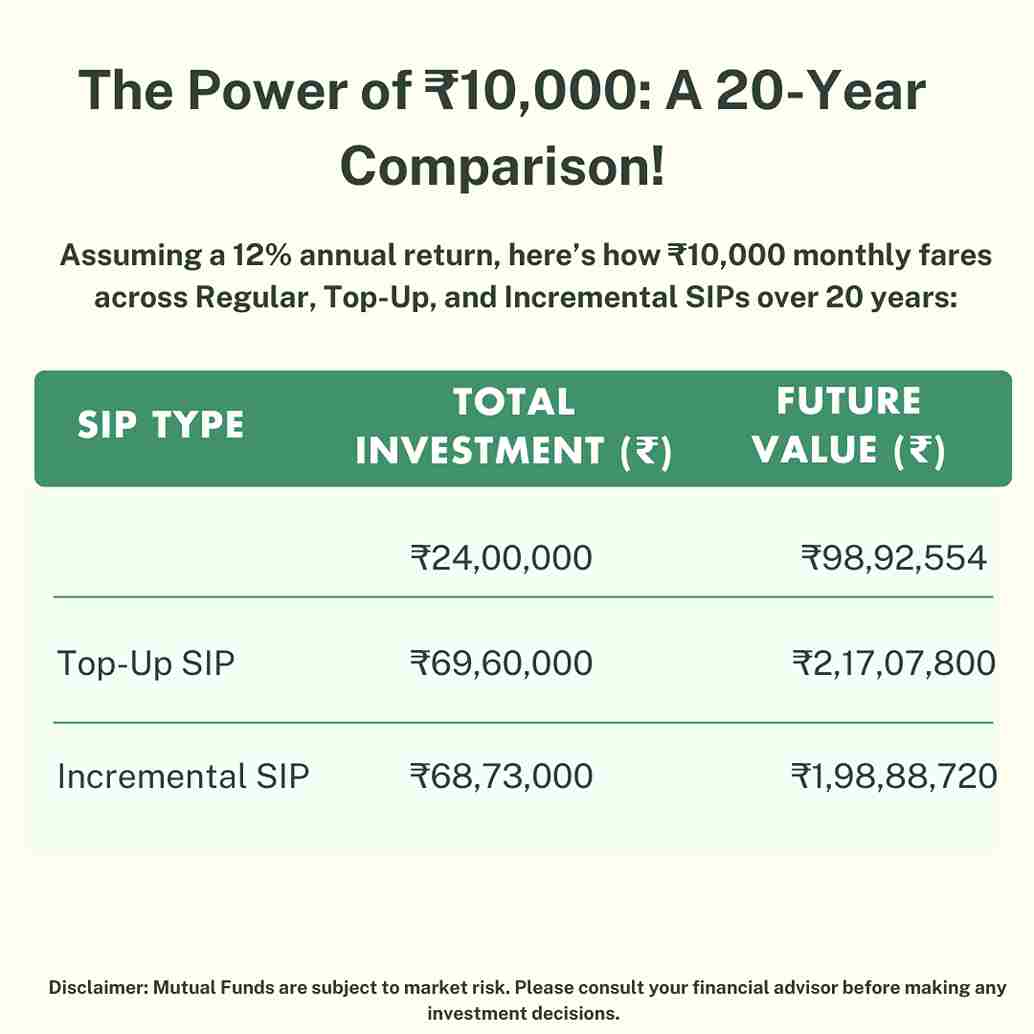

Think of Regular SIP as a jogger who maintains a consistent pace for 20 years, neither speeding up nor slowing down. It’s simple, predictable, and effective for reaching the finish line. For example, you invest ₹10,000 every month for 20 years. You’ve invested ₹24,00,000 and earned a future value of ₹98,92,554 at an assumed 12% annual return.

Who is it for?

● New investors who prefer simplicity.

● Individuals with a fixed income.

2. Top-Up SIP: The Gradual Weightlifter

Top-Up SIP is like a weightlifter who gradually increases the weight. You start small but increase your contributions every year, making this a powerful strategy for wealth creation. Considering the above example: you start with a ₹10,000 SIP per month and increase it by ₹2,000 every year. Total Investment would be around: ₹69,60,000 with a Future Value of ₹2,17,07,800 as considering the annualised return of 12%.

Who is it for?

● Salaried individuals expecting annual increments.

● Those aiming to boost their savings as income grows.

3. Incremental SIP: The Adaptive Runner

Incremental SIP is like a marathon runner who starts at a steady pace but increases speed by a certain percentage each year. This strategy compounds both your investments and your ability to save. Considering the above example: you Start with a SIP of ₹10,000 per month and increase it by 10% annually. Total Investment would be around ₹68,73,000 Future Value: ₹1,98,88,720

Who is it for?

● Business owners or professionals with percentage-based income growth.

● Investors looking for compounding benefits on their contributions..

Why Top-Up and Incremental SIPs Shine?

While Regular SIP is great for beginners or those with fixed incomes, Top-Up and Incremental SIPs leverage income growth, inflation, and the power of compounding to maximize wealth.

Key Benefits:

● Adapts to Growth: As your income grows, so does your investment.

● Outpaces Inflation: Increased contributions help maintain purchasing power.

● Compounds Faster: Higher amounts invested earlier reap bigger compounding benefits.

Conclusion: The Marathon of Wealth

Investing is a marathon, not a sprint. Whether you stick to a steady pace (Regular SIP), increase your stride annually (Top-Up SIP), or run faster every year (Incremental SIP), the key is to stay consistent.

Remember, it’s not just about the amount you invest but how you adapt to your financial journey. Choose the SIP strategy that best aligns with your goals, and watch your wealth grow like never before.

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented in our newsletter and blogs is solely for informational purpose!

Thematic Funds in India: A Growing Trend in Investment!

30th January 2025

Multi-Asset Funds in India: Diversification Made Easy for Investors

16th December 2024

Multi-Cap vs Flexi-Cap Mutual Funds: Where to Invest in 2024?

26th September 2024

A Comprehensive Guide to NFO: New Fund Offer

12th September 2024