How Investors Should React During a Market Correction? Do's and Don'ts!

5th March 2025 | Author : Centricity

A stock market correction occurs when major indices fall by 10% or more from their recent highs. While corrections can be unsettling, they are a normal part of market cycles. For investors, how they react during these downturns can significantly impact their long-term wealth. Here’s a detailed guide on the do’s and don’ts of navigating a market correction.

What is a Market Correction?

A market correction occurs when a stock index, such as the S&P 500, Nifty 50, or Dow Jones, falls by at least 10% but less than 20%. If the decline extends beyond 20%, it is classified as a bear market. Corrections are usually triggered by economic slowdowns, geopolitical tensions, monetary policy changes, or investor sentiment shifts.

Historical Frequency of Market Corrections

Historically, stock market corrections happen more often than bear markets. On average, corrections occur:

● Every 1 to 2 years in major indices.

● They typically last 3 to 4 months before markets recover.

● A full recovery to previous highs usually takes 4 to 6 months.

Major Market Corrections in History

Here are some notable corrections and their impact:

1. Black Monday (1987): The Dow Jones plunged 22.6% in one day, triggered by algorithmic trading and economic concerns. The market recovered in less than two years.

2. Dot-Com Bubble (2000-2002): A significant correction led to a prolonged bear market as internet stocks collapsed.

3. Global Financial Crisis (2008-2009): The S&P 500 fell over 50%, leading to a major recession before recovering in 2012.

4. COVID-19 Crash (2020): The stock market plummeted by over 30% within weeks but rebounded quickly due to stimulus measures.

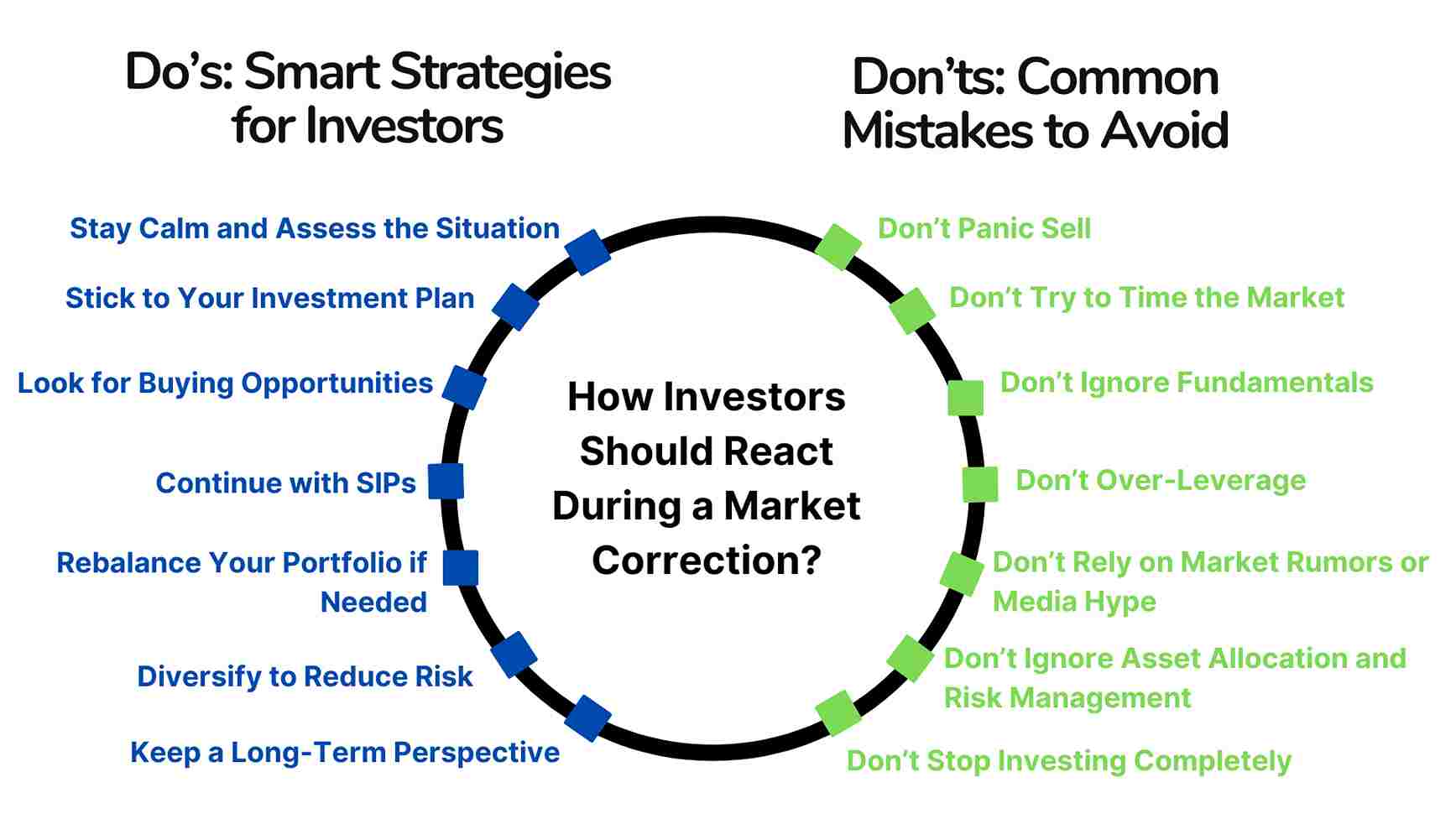

Do’s: Smart Strategies for Investors

1. Stay Calm and Assess the Situation

Market corrections can trigger panic among investors, leading to impulsive decisions. It’s crucial to stay calm and analyze whether the correction is driven by fundamental issues or short-term volatility. Reviewing economic indicators and corporate earnings reports can provide clarity on the market’s direction.

2. Stick to Your Investment Plan

A well-thought-out investment strategy considers both bull and bear market conditions. If you have a diversified portfolio aligned with your financial goals, there’s no need to make hasty changes. Stick to your asset allocation strategy and avoid knee-jerk reactions.

3. Look for Buying Opportunities

Market corrections often create opportunities to buy high-quality stocks at a discount. Conduct research and identify fundamentally strong companies that have temporarily declined in price. Long-term investors can take advantage of lower valuations to accumulate shares of blue-chip or growth stocks.

4. Continue with Systematic Investment Plans (SIPs)

If you invest in mutual funds through SIPs, a market correction works in your favor by allowing you to buy more units at lower prices. Staying invested ensures that you benefit when the market rebounds.

5. Rebalance Your Portfolio if Needed

A market correction might lead to an imbalance in your asset allocation. If your equity portion has declined significantly, consider rebalancing by adding more stocks or reducing exposure to other asset classes. However, ensure your moves are based on a strategic plan rather than emotions.

6. Diversify to Reduce Risk

Diversification across different sectors, asset classes, and geographical regions can help mitigate losses during corrections. Holding a mix of equities, bonds, gold, and other assets ensures that not all investments decline simultaneously.

7. Keep a Long-Term Perspective

Market corrections are temporary, but a solid investment portfolio can deliver returns over time. Historically, markets have always rebounded from corrections and reached new highs. Investors who stay the course are often rewarded in the long run.

Don’ts: Common Mistakes to Avoid

1. Don’t Panic Sell

Selling investments in a panic when the market declines locks in losses and prevents you from benefiting from future recoveries. Many investors sell at the bottom and re-enter at higher prices, hurting their overall returns.

2. Don’t Try to Time the Market

Predicting market bottoms or tops is nearly impossible. Instead of waiting for the ‘perfect’ time to buy or sell, focus on disciplined investing through systematic plans. Attempting to time the market often leads to missed opportunities and increased risk.

3. Don’t Ignore Fundamentals

During a correction, stock prices may fall sharply, but that doesn’t always mean they are good investments. Ensure that companies you invest in have strong financials, sustainable business models, and solid growth prospects before making buying decisions.

4. Don’t Over-Leverage

Using borrowed money to invest can amplify losses during a market correction. If you’ve taken loans or used margin trading, a downturn can lead to significant financial stress. Avoid excessive leverage and ensure your investments align with your risk appetite.

5. Don’t Rely on Market Rumors or Media Hype

Market corrections often lead to fear-driven headlines and speculation. Avoid making decisions based on rumors, sensational news, or social media hype. Rely on data-driven analysis and expert insights when making investment choices.

6. Don’t Ignore Asset Allocation and Risk Management

If you’re heavily invested in one sector or asset class, a correction can hit your portfolio hard. Ensure that your investments are spread across different assets to cushion against market downturns.

7. Don’t Stop Investing Completely

Some investors halt all investments during corrections, fearing further declines. However, regular investing—especially when stocks are at lower valuations—can help maximize long-term returns. Consider dollar-cost averaging to take advantage of lower prices.

Conclusion: Market corrections are inevitable but temporary. By staying calm, sticking to a solid investment plan, and avoiding emotional decisions, investors can navigate downturns effectively. The key is to see corrections as opportunities rather than threats, positioning oneself for long-term growth. With discipline and patience, investors can emerge stronger from market corrections and build lasting wealth.

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented under our newsletter and blogs is solely for informational purposes!

Arbitrage Funds: A Safe Haven or a Strategic Investment?

26th December 2024

Why Index Funds Are Gaining Popularity in India?

5th September 2024

How to Avoid Making Poor Investment Decisions?

16th August 2024