Grow Your SIP Budget: Creating Wealth with the New Union Budget!

13th February 2025 | Author : Centricity

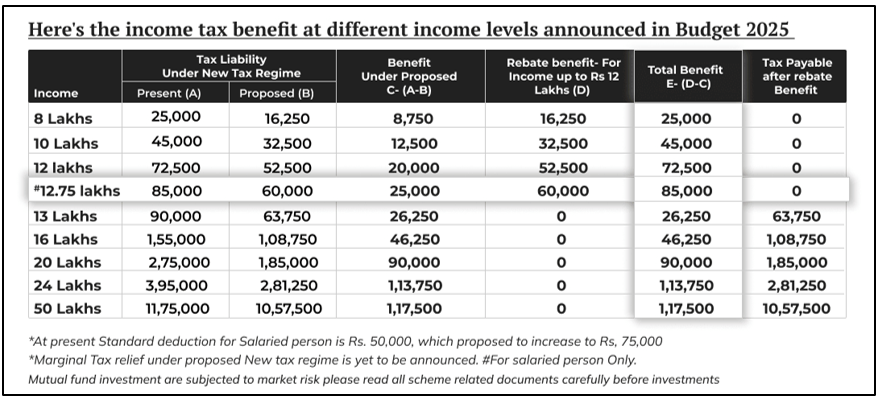

The recently announced Union Budget 2025-26 has brought a fresh wave of opportunities for salaried individuals and middle-class investors. With an increase in the income tax exemption limit to ₹12 lakh per annum, there is a significant boost in disposable income. This policy shift opens the door for enhanced savings and investments, particularly through Systematic Investment Plans (SIPs). By strategically allocating these additional savings, investors can accelerate their wealth creation journey while benefiting from tax efficiency and market growth.

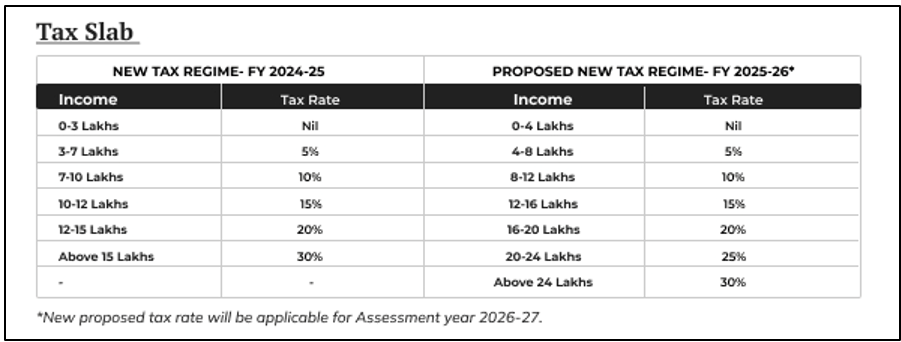

Understanding the New Tax Reforms

Finance Minister Nirmala Sitharaman announced that individuals earning up to ₹12 lakh annually would now be exempt from income tax under the new regime.

The finance minister has announced an increase in the tax rebate under Section 87A to Rs 60,000 from Rs 25,000 under the current tax regime currently. The maximum total taxable income under the proposed new tax regime for which an individual taxpayer has no tax burden is Rs. 12 lakhs (and Rs 12.75 lakh for salaried people). Currently, the limit of income for nil tax payments is Rs 7 lakh till March 31, 2025.

The increase in disposable income offers an excellent opportunity for individuals to enhance their financial planning. Instead of merely increasing lifestyle expenses, the smart move would be to channel this surplus into investments like SIPs that provide long-term growth.

Why SIPs Are an Ideal Investment Choice?

SIPs in mutual funds are an effective way to build wealth over time. They allow investors to contribute a fixed amount regularly, benefiting from rupee cost averaging and the power of compounding. Investing systematically helps reduce the impact of market volatility while maintaining financial discipline.

How to Grow Your SIP Budget with the Additional Tax Savings?

With the increased tax exemption, here’s how you can allocate your surplus wisely:

1. Increase Your Monthly SIP Contribution

If you were previously investing ₹5,000 per month in SIPs, consider increasing it by 20-30% using the additional savings from reduced tax liabilities. Even a small increase can have a significant impact over the long term. For example, an increase from ₹5,000 to ₹6,500 per month in an SIP yielding an average 12% annual return could result in substantial wealth accumulation over 15-20 years.

2. Diversify Your Portfolio

While equity SIPs remain a preferred choice for long-term investors, consider allocating funds across:

● Equity Mutual Funds – Ideal for wealth creation over a long period.

● Debt Mutual Funds – Provide stability and reduce overall portfolio risk.

● Balanced Advantage Funds – Help balance risk and reward by dynamically adjusting between equity and debt.

3. Leverage Tax-Saving SIPs

Investing in an Equity-Linked Savings Scheme (ELSS) allows you to enjoy tax benefits under Section 80C while participating in market growth. ELSS funds have a lock-in period of three years and typically offer higher returns compared to traditional tax-saving instruments.

4. Align Investments with Financial Goals

Determine whether you’re saving for short-term needs (like a house down payment) or long-term goals (such as retirement). Based on your risk appetite, allocate funds to different types of mutual funds to optimize returns while ensuring financial security.

Multiplier Effect on the Economy

In addition to encouraging household savings and investments, the government's tax exemption limit increase is expected to stimulate economic growth. In addition to benefiting individual investors, increased SIP contributions boost corporate investments and economic growth by driving liquidity into the financial markets.

Furthermore, the additional disposable income will fuel demand in various sectors, such as consumer goods, real estate, and automobiles, boosting the economy as a whole.

Final Thoughts

The Union Budget 2025-26 presents a favourable landscape for individuals to enhance their financial well-being. By strategically increasing SIP contributions using the additional tax savings, investors can secure their future while participating in economic growth.

With disciplined investing, diversification, and the power of compounding, the middle class can take advantage of this financial boost to build substantial wealth over time. As always, consulting a financial advisor to tailor an investment strategy aligned with personal goals and risk appetite is a wise step towards financial success.

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented under our newsletter and blogs is solely for informational purposes.