Arbitrage Funds: A Safe Haven or a Strategic Investment?

26th December 2024 | Author : Centricity

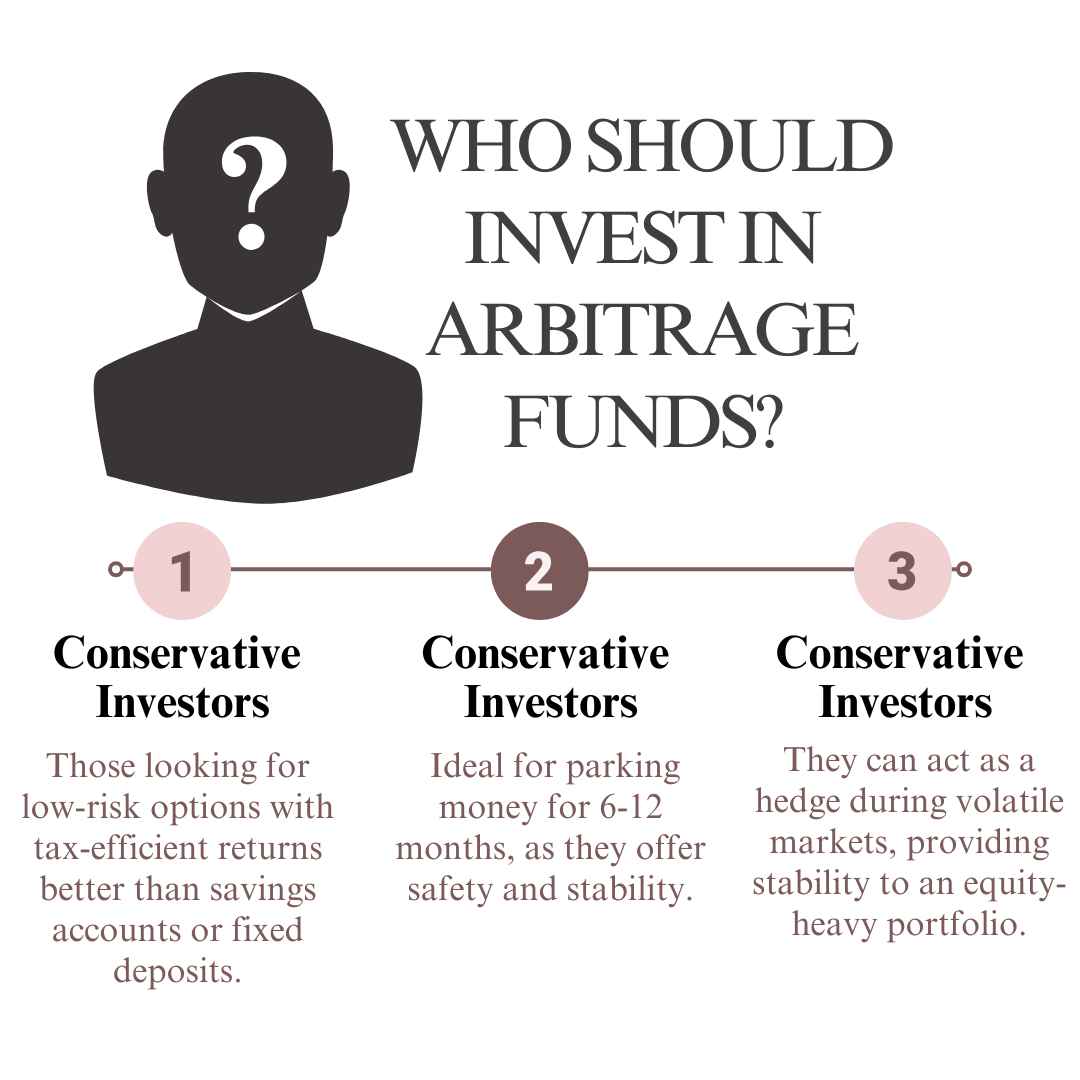

Imagine this: Ravi, a cautious investor, wants to park his money in a fund that provides better returns than a savings account but without the volatility of equities. On the other hand, Priya, an aggressive investor, is looking for a low-risk tool to balance her portfolio. For both Ravi and Priya, arbitrage funds could be the answer. But what exactly are arbitrage funds, and should they be in your portfolio? Let’s explore.

What Are Arbitrage Funds?

Arbitrage funds are mutual funds that capitalise on the price differences between the cash market (spot market) and the derivatives market. The term "arbitrage" refers to simultaneously buying and selling the same asset in different markets to profit from price discrepancies.

Here’s how it works:

● Fund managers buy stocks in the cash market and simultaneously sell them in the futures market at a higher price.

● At the contract's expiry, the price gap between the two markets becomes the fund's profit.

Since these funds predominantly operate in hedged positions, the risk of loss due to market volatility is minimal. SEBI (Securities and Exchange Board of India) mandates that arbitrage funds allocate at least 65% of their assets to equities, ensuring tax efficiency like equity funds.

How Do Arbitrage Funds Work?

Let’s break this down with an example:

1. A stock trades at ₹1,000 in the cash market, while its futures price is ₹1,010.

2. The arbitrage fund buys the stock in the cash market and sells it in the futures market.

3. At expiry, the fund earns ₹10 per share (the difference between the futures price and cash market price), regardless of market movements.

This strategy thrives in volatile markets, where price gaps are more frequent and wider, offering better arbitrage opportunities.

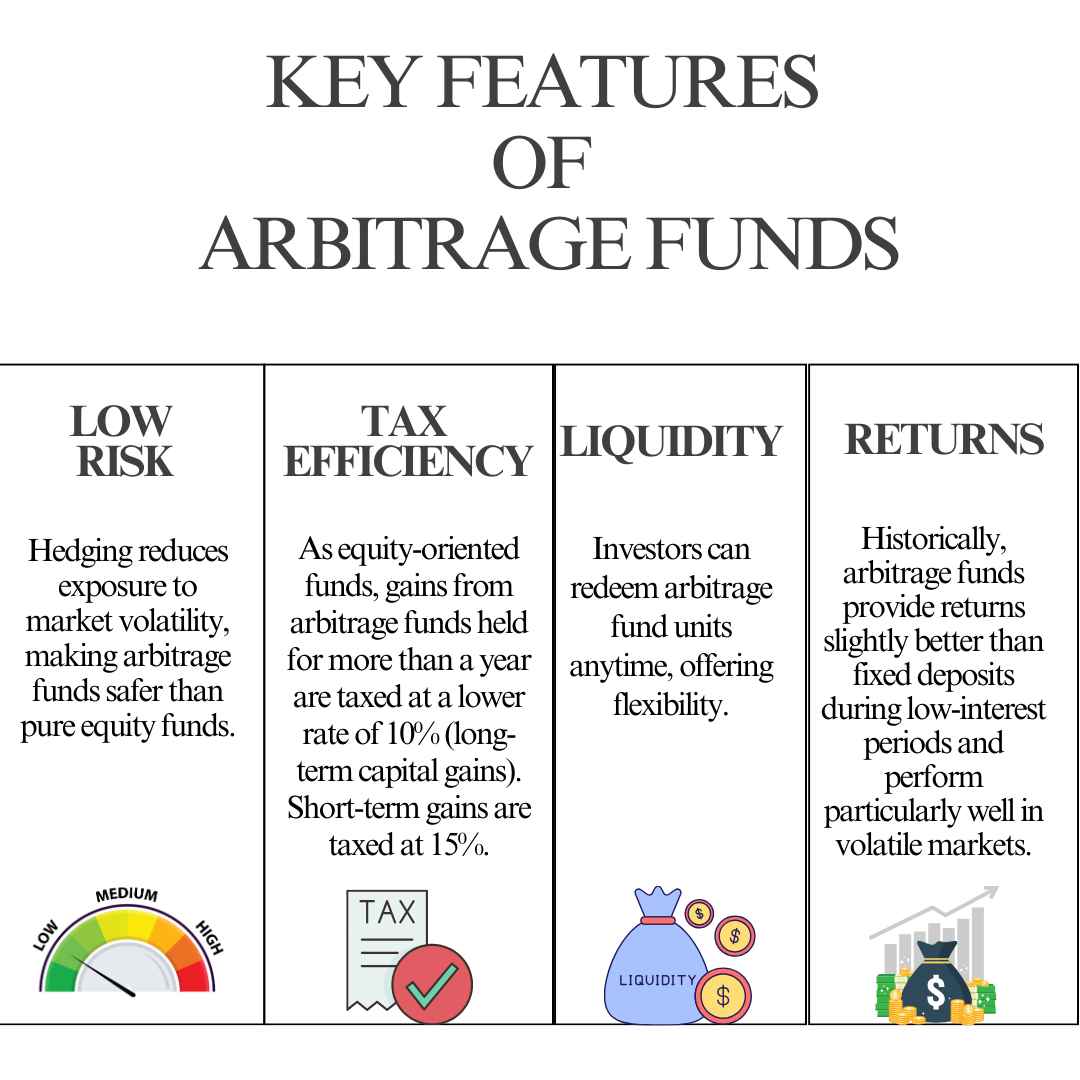

Benefits of Arbitrage Funds

1. Risk Mitigation: The hedged positions significantly reduce the risk of market fluctuations.

2. Stable Returns: While returns are not as high as pure equity funds, they are more stable, making them suitable for risk-averse investors.

3. Tax Advantages: Equity taxation rules make these funds more attractive than debt funds for short-term goals.

4. No Lock-In Period: Unlike fixed deposits or other savings instruments, arbitrage funds have no lock-in, offering flexibility to investors.

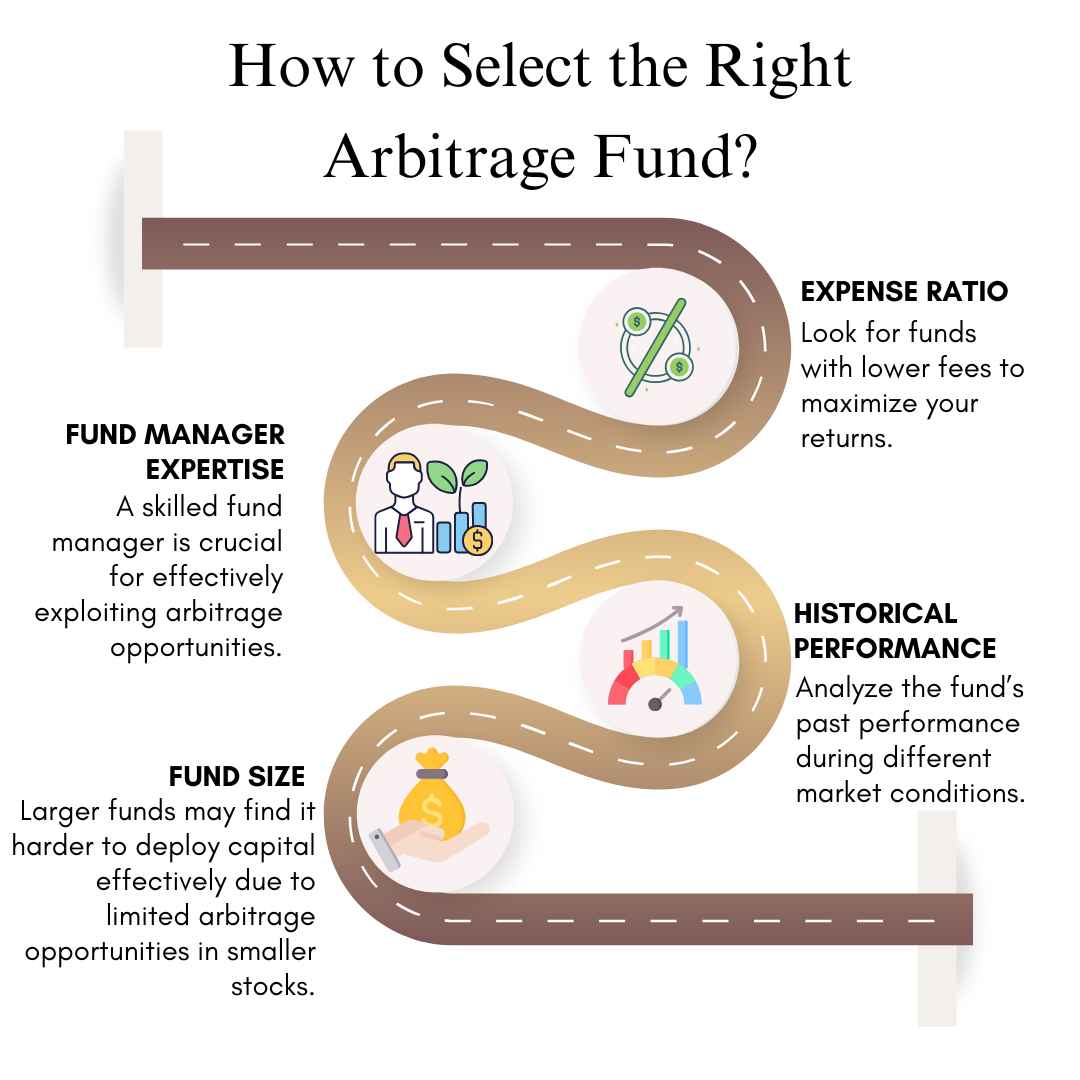

How to Select the Right Arbitrage Fund?

Should You Add Arbitrage Funds to Your Portfolio?

The decision to invest in arbitrage funds depends on your financial goals, risk appetite, and market conditions. Here’s a quick guide:

● When to Invest:

○ In volatile markets: Arbitrage funds thrive when market movements create pricing gaps.

○ For short-term goals: If you need to park money for 6-12 months, these funds are an excellent option.

● When to Avoid:

○ In stable markets: Returns may not be attractive enough.

○ For long-term goals: Equity or hybrid funds are better suited for wealth creation.

Conclusion

Arbitrage funds strike a balance between safety and moderate returns, making them an excellent choice for risk-averse investors or those looking to diversify their portfolios. While not a high-return option, they shine in volatile conditions, offering a haven for short-term investments.

Whether you are Ravi, the cautious investor, or Priya, the strategic planner, arbitrage funds could be a valuable addition to your investment strategy. However, always consider market conditions and consult a financial advisor before making decisions.

By blending stability with tax efficiency, arbitrage funds ensure that your money works as hard as you do—calmly and quietly delivering steady returns.

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented under our newsletter and blogs is solely for informational purpose

Why Index Funds Are Gaining Popularity in India?

5th September 2024

How to Avoid Making Poor Investment Decisions?

16th August 2024