Thematic Funds in India: A Growing Trend in Investment!

30th January 2025 | Author : Centricity

The Indian mutual fund industry has witnessed significant evolution in recent years, with investors looking beyond traditional investment vehicles to maximize returns. The MF Industry's AUM has grown from ₹ 26.54 trillion as of December 31, 2019, to ₹66.93 trillion as of December 31, 2024. One such product gaining traction is thematic funds. These funds are designed to capitalize on specific investment themes, sectors, or ideas, offering a unique opportunity for those with a keen eye on market trends.

While they present high-risk, high-reward potential, thematic funds have become an appealing option for savvy investors looking to align their portfolios with long-term trends.

In this article, we explore thematic funds, their growing popularity in India, and their performance metrics.

What Are Thematic Funds?

Thematic funds are a type of equity mutual fund that invests in stocks based on a specific theme or sector. Unlike diversified equity funds, which aim to spread risk across various industries, thematic funds concentrate their portfolio around a defined idea. Common themes include technology, healthcare, infrastructure, consumption, ESG (Environmental, Social, and Governance), and international trends like electric vehicles or green energy.

For instance, a thematic technology fund would invest in companies engaged in IT services, software development, e-commerce, or digital transformation. Similarly, an ESG fund focuses on companies adhering to sustainable business practices.

Growth of Thematic Funds in India!

Thematic funds have gained traction in India due to increasing awareness among retail investors and a growing appetite for differentiated investment options. According to AMFI (Association of Mutual Funds in India), thematic and sectoral funds witnessed a combined inflow of ₹11,500 crore between January and October 2023, up by 18% compared to the same period in 2022.

Moreover, with the government's focus on initiatives like Digital India, Make in India, and green energy transition, thematic funds have become an attractive choice for those aiming to capitalize on these structural growth stories.

Why Invest in Thematic Funds?

1. Focused Investment Opportunities: Thematic funds allow investors to capitalize on emerging trends and long-term growth opportunities. For example, India’s push for renewable energy has driven the success of green energy thematic funds.

2. Diversification within a Theme: While thematic funds concentrate on a specific idea, they still provide diversification by investing across multiple companies within that theme.

3. Alignment with Personal Beliefs: ESG-themed funds are particularly popular among investors who wish to align their investments with their ethical and environmental values.

4. Higher Growth Potential: By tapping into sectors poised for rapid growth, thematic funds can deliver higher returns compared to broader market funds during favourable market conditions.

Risks Associated with Thematic Funds

Despite their appeal, thematic funds come with a unique set of risks that investors must consider:

1. Concentration Risk: The focus on a specific theme means that the portfolio is less diversified, making it more susceptible to sector-specific downturns.

2. Market Cyclicality: Some themes are heavily influenced by economic or market cycles. For example, infrastructure funds may underperform during economic slowdowns.

3. Higher Volatility: Since these funds focus on niche areas, they tend to exhibit higher volatility compared to diversified equity funds.

4. Longer Gestation Periods: Some themes, such as electric vehicles or green energy, may require a longer time horizon to yield meaningful returns.

Final Thoughts

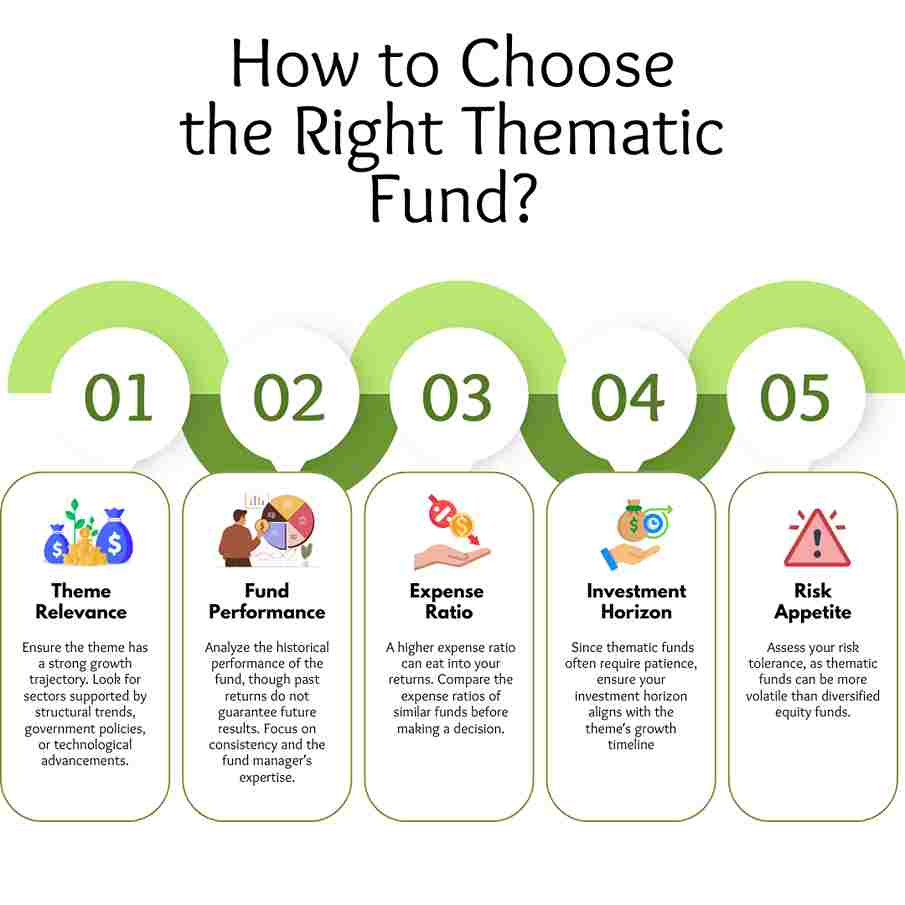

Thematic funds in India offer an exciting opportunity to participate in high-growth sectors and align investments with emerging trends. However, they are not a one-size-fits-all solution. Investors should approach thematic funds with a clear understanding of the associated risks and align their investments with their financial goals and risk appetite.

As India continues its journey towards becoming a $5 trillion economy, thematic funds are likely to remain a compelling choice for investors seeking to ride the wave of transformative economic shifts. With careful planning and due diligence, thematic funds can be a valuable addition to an investor’s portfolio, combining focus with potential high returns.

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented under our newsletter and blogs is solely for informational purposes.

Are you investing in SIPs smartly ?

21st January 2025

Multi-Asset Funds in India: Diversification Made Easy for Investors

16th December 2024

Multi-Cap vs Flexi-Cap Mutual Funds: Where to Invest in 2024?

26th September 2024

A Comprehensive Guide to NFO: New Fund Offer

12th September 2024