Multi-Cap vs Flexi-Cap Mutual Funds: Where to Invest in 2024?

26th September 2024 | Author : Centricity

Investors looking for long-term wealth creation often choose between multi-cap and flexi-cap mutual funds. Both categories provide diversified exposure to large-cap, mid-cap, and small-cap stocks but follow distinct strategies. In 2024, with markets displaying both growth opportunities and volatility, understanding the differences between these fund types can help you make an informed investment decision.

This article will break down the differences, highlight the latest performance data, and guide you on which fund might suit your investment needs in the current market.

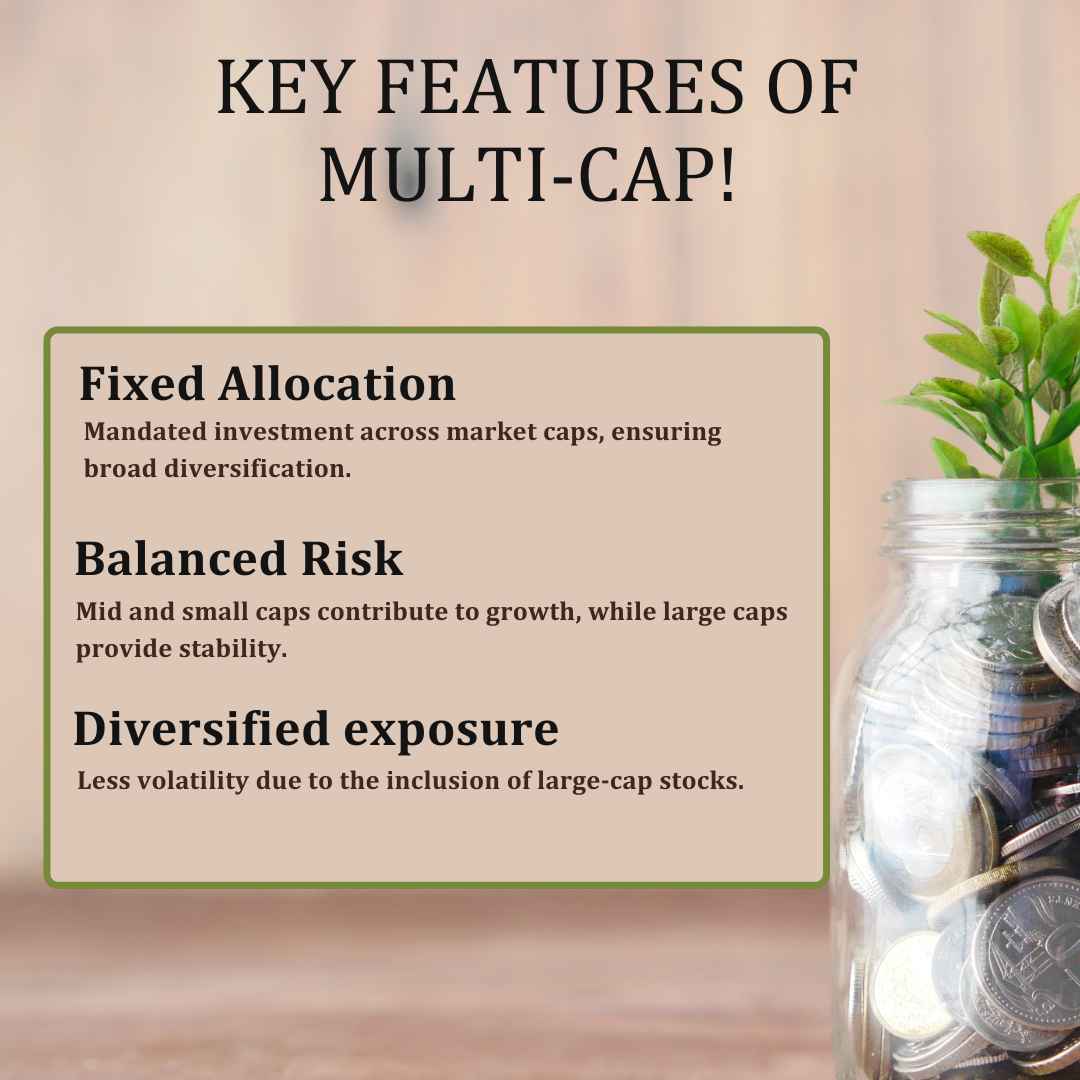

What Are Multi-Cap Mutual Funds?

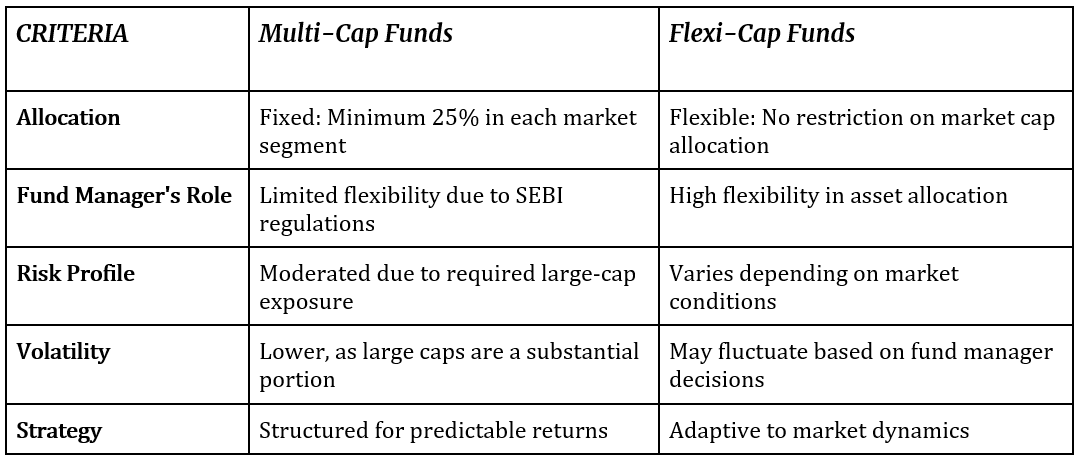

Multi-cap mutual funds are equity funds required to invest in companies across large, mid, and small-cap segments, with a minimum 25% allocation to each category. This rule ensures that the portfolio is consistently diversified across the market spectrum.

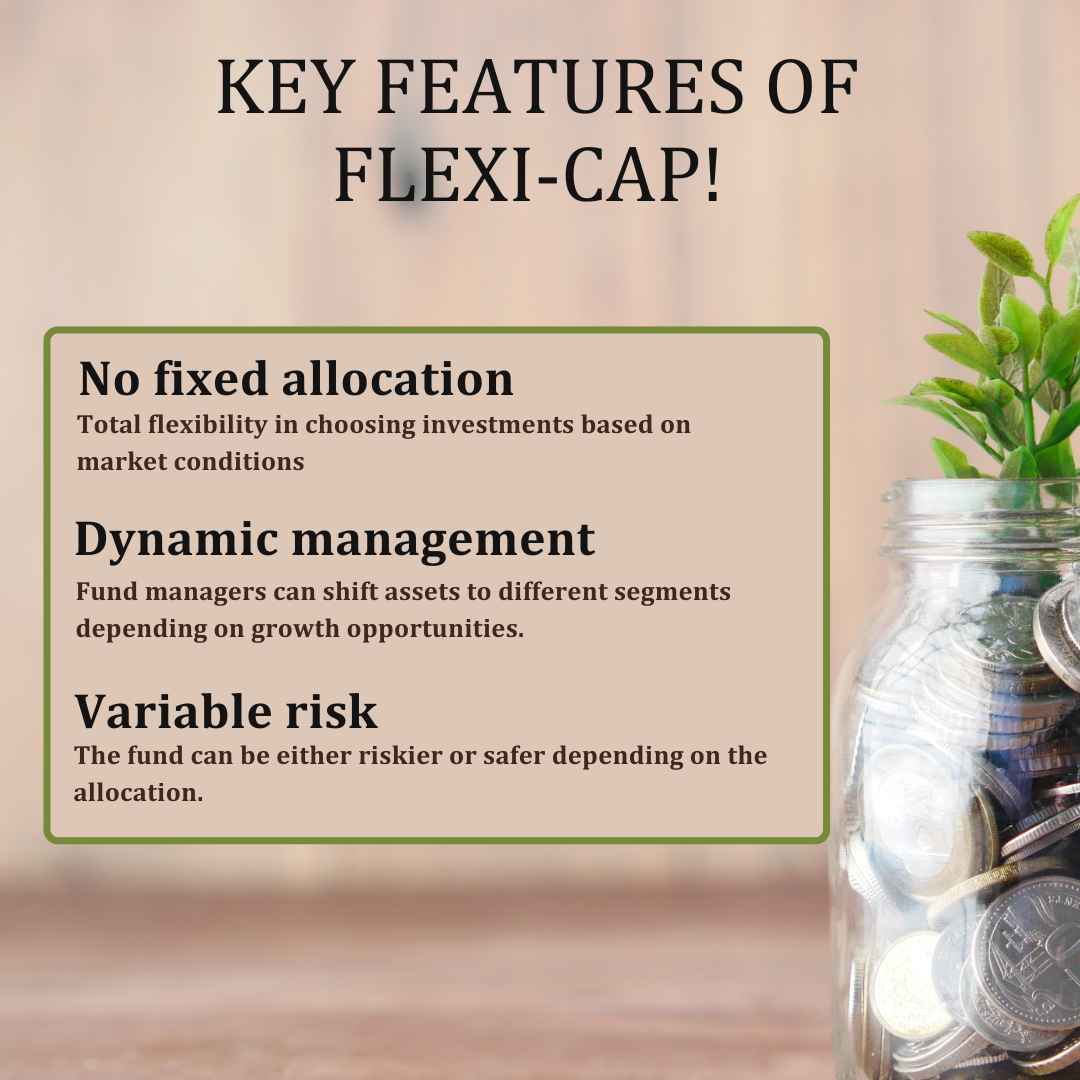

What Are Flexi-Cap Mutual Funds?

Introduced by SEBI in 2020, flexi-cap mutual funds are not bound by any fixed allocation. Fund managers can invest in large, mid, and small-cap stocks in any proportion based on market conditions, giving them the flexibility to adjust the portfolio dynamically.

Key Differences Between Multi-Cap and Flexi-Cap Mutual Funds

Performance Comparison: Multi-Cap vs Flexi-Cap in 2024

Multi-cap and flexi-cap funds have delivered strong performances in 2024, but their strategies have led to slightly different results.

Flexi-Cap Funds:

Flexi-cap funds, with their ability to adjust allocations, have seen strong inflows and returns this year. As of September 2024, these funds achieved the following performance:

- 1-year returns: 37.20%

- 5-year annualized returns: 22.04%

The flexibility of these funds allows them to capitalize on market opportunities more effectively, contributing to their popularity. For instance, in August 2024 alone, inflows into flexi-cap funds reached ₹3,513 crore, reflecting high investor confidence.

Multi-Cap Funds:

Despite having fixed allocation rules, multi-cap funds have also delivered robust returns:

- 1-year returns: 39.79%

- 5-year annualized returns: 25.70%

The structured exposure to mid and small-cap stocks in multi-cap funds has helped them achieve slightly higher returns compared to flexi-cap funds over the past year. However, their rigid allocation may limit flexibility during volatile market conditions.

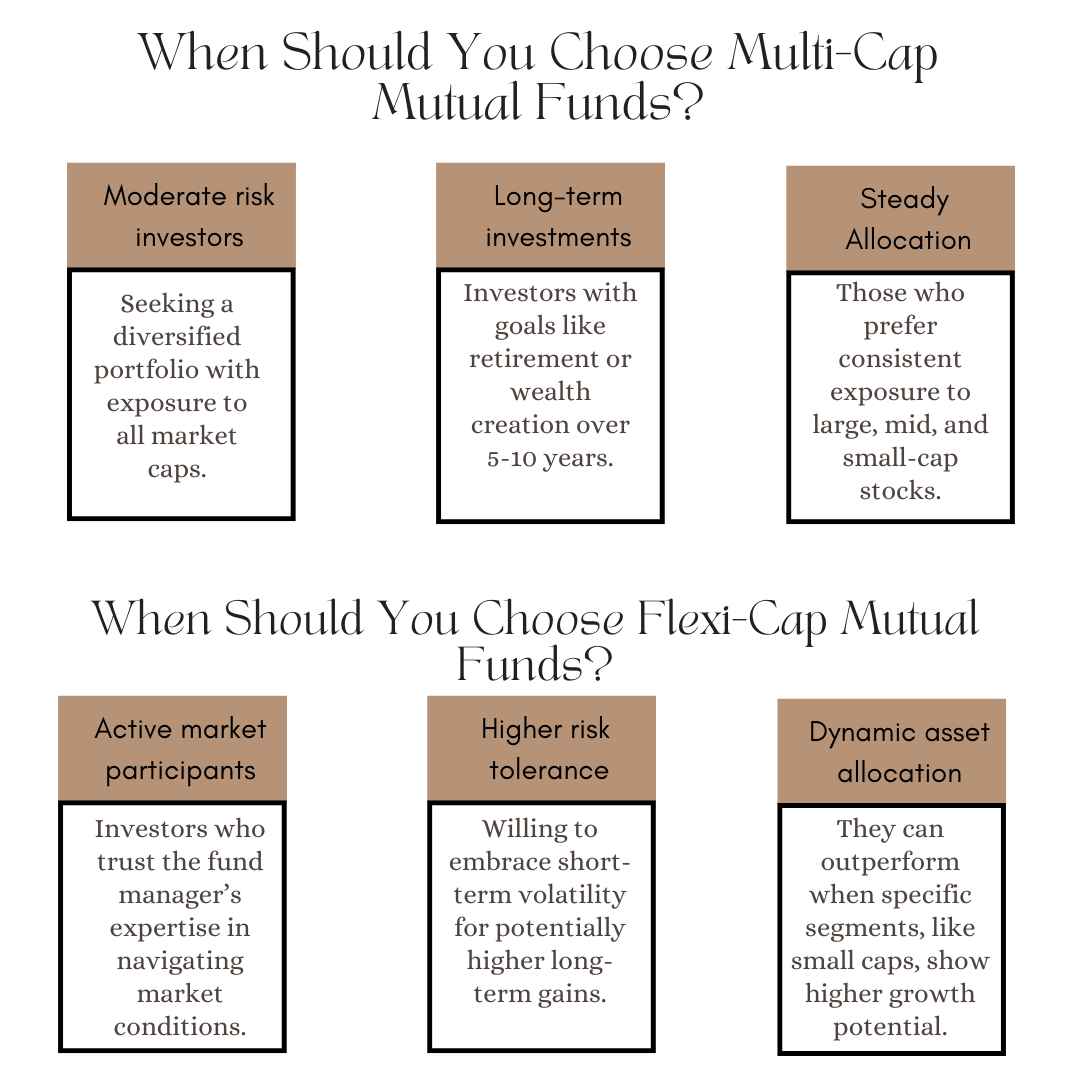

When Should You Choose Multi-Cap/ Flexi-Cap Mutual Funds?

Multi-cap funds are ideal for investors who prefer a balanced exposure to the entire market, without relying on the fund manager’s discretion to shift allocations. Whereas, Flexi-cap funds are suitable for investors looking for higher flexibility and the ability to adjust asset allocations based on market trends.

Current Market Outlook: Where to Invest?

In 2024, the Indian market has seen mixed performance across sectors. Global uncertainties, inflation, and interest rate fluctuations have contributed to volatility, making fund selection crucial for portfolio growth.

- Multi-Cap Funds: Provide a balanced approach, making them ideal for risk-averse investors. The fixed allocation to large caps ensures stability, while mid and small caps offer growth potential.

- Flexi-Cap Funds: For investors willing to take more risk, flexi-cap funds offer a dynamic approach. Fund managers can adjust portfolios to maximize returns depending on sectoral trends, making these funds ideal in volatile market conditions.

Conclusion: Which Should You Choose?

- Choose Multi-Cap Funds if you prefer structured diversification and want to avoid heavy reliance on fund manager discretion.

- Choose Flexi-Cap Funds if you seek flexibility and trust active management to adapt to market shifts, especially in times of economic uncertainty.

Both fund types have advantages, and your decision should be based on your risk tolerance, investment horizon, and market outlook.

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented under our newsletter and blogs is solely for informational purpose

Thematic Funds in India: A Growing Trend in Investment!

30th January 2025

Are you investing in SIPs smartly ?

21st January 2025

Multi-Asset Funds in India: Diversification Made Easy for Investors

16th December 2024

A Comprehensive Guide to NFO: New Fund Offer

12th September 2024