Financial

Products

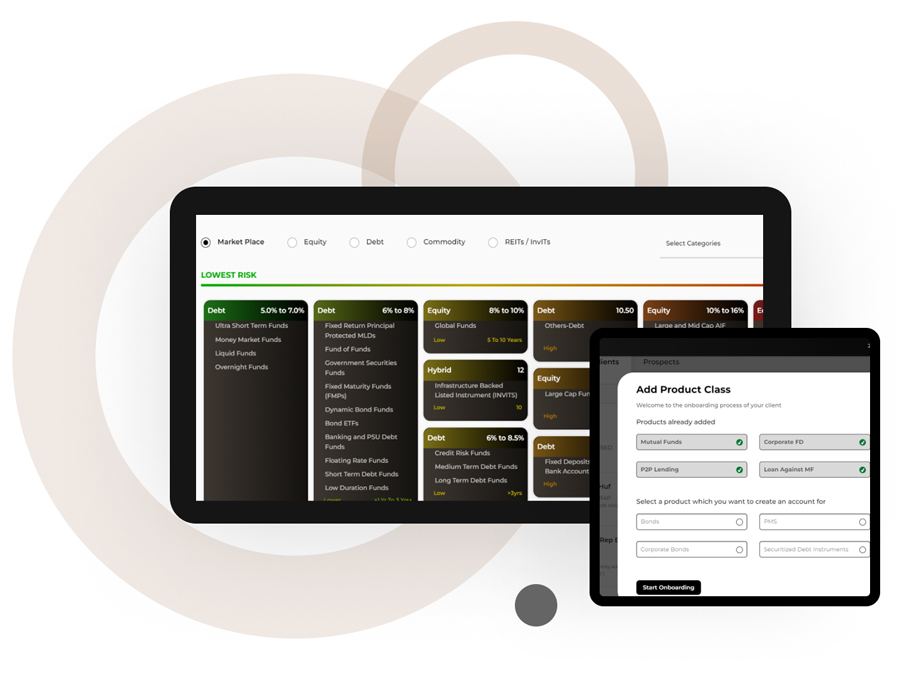

Explore our comprehensive range of financial products!

-

40+ Mutual Fund AMCs

40+ Mutual Fund AMCs

-

50+ PMS/AIF Managers

50+ PMS/AIF Managers

-

100+ Bonds

100+ Bonds

-

50+ Pre-IPO Equity Stocks

50+ Pre-IPO Equity Stocks

Select Asset class

Equity Funds are mutual fund schemes which invest their assets in stocks of different companies based on the investment objective of the underlying scheme. These funds are a great investment option for capital appreciation as they have the potential for long- term wealth creation.

A debt mutual fund invests a significant portion of your money in fixed-income securities & other money-market instruments. Debt mutual funds lower the risk factor considerably with comparatively higher return for investors. This a stable investment avenue that could help to generate wealth.

PMS is a professional financial service in which skilled, qualified & experienced fund managers & professionals manage equity or debt portfolios to achieve specific objectives. As per SEBI regulation, the minimum investment ticket for investing in PMS is Rs. 50 lakhs.

Alternate Investment Funds are funds established in India as a privately pooled investment vehicle to collect funds from sophisticated investors. AIFs invest in listed & unlisted asset classes but are more focused on investing in instruments other than asset classes such as equity & debt. The minimum investment required is 1crores!

A debt bond is a type of investment where you lend money to a company or government in exchange for regular interest payments and return of the principal amount for a specific period.

Unlisted shares are private equity shares that are not listed on any stock exchange. They are owned by a smaller group of investors, including founders, early-stage investors & employees. They are not traded publicly but are bought and sold in the over-the-counter market. Additionally, they are not subject to the same regulatory requirements & obligations. By investing in unlisted, investors get greater control & influence over the company.

Corporate FD is a term deposit which is held over fixed period at fixed rates of interest. Company Fixed Deposits are offered by Financial and Non-Banking financial companies (NBFCs). The maturities of various company fixed deposits can range from a few months to a few years.