Multi-Asset Funds in India: Diversification Made Easy for Investors

16th December 2024 | Author : Centricity

In the dynamic world of investments, diversification is key to managing risks and optimizing returns. Multi-asset funds are becoming increasingly popular in India as they expose investors to a mix of asset classes like equity, debt, commodities, and sometimes gold or real estate, all within a single investment vehicle. These funds are designed to balance risk and reward by spreading investments across different assets, offering both stability and growth potential.

This article will explore Multi-Asset Funds, how they work, their benefits, and how investors can use them to meet their financial goals.

What are Multi-Asset Funds?

Multi-asset funds are diversified investment funds that allocate money across multiple asset classes, such as:

● Equity (Stocks): For long-term growth opportunities.

● Debt Instruments (Bonds): For steady income and capital protection.

● Gold: Acts as a hedge against inflation and economic volatility.

● Commodities: Investments in raw materials or other market commodities.

These funds are actively or passively managed, and their strategy focuses on achieving optimal risk-adjusted returns by dynamically allocating capital across the aforementioned assets based on market conditions.

How Do Multi-Asset Funds Work?

Multi-asset funds work by investing in a diversified portfolio of assets to spread out risks. They operate based on asset allocation strategies. The fund managers allocate funds to equity, debt, or other assets depending on market trends, economic conditions, inflation, and investor sentiment.

For instance:

● In a bull market, equity might take precedence to maximize returns.

● In a recession or volatile market, the focus may shift toward debt and gold to reduce risk.

Investors buy units in a multi-asset fund, and the fund manager manages these assets on their behalf. Investors benefit from a balanced mix of risk, growth, and diversification without allocating investments manually.

Risks Associated with Multi-Asset Funds

While Multi-Asset Funds provide diversification, they are not risk-free. Investors must assess these risks before investing:

1. Market Risk: Changes in equity or commodity market trends can affect returns.

2. Interest Rate Risk: Changes in interest rates can impact the debt portion of MAFs.

3. Asset Misallocation Risk: If the fund manager does not allocate assets wisely, returns may be suboptimal.

4. Liquidity Risk: Some assets (especially commodities or real estate) might have liquidity constraints.

Investors must therefore stay informed and choose funds with strong management and proven track records.

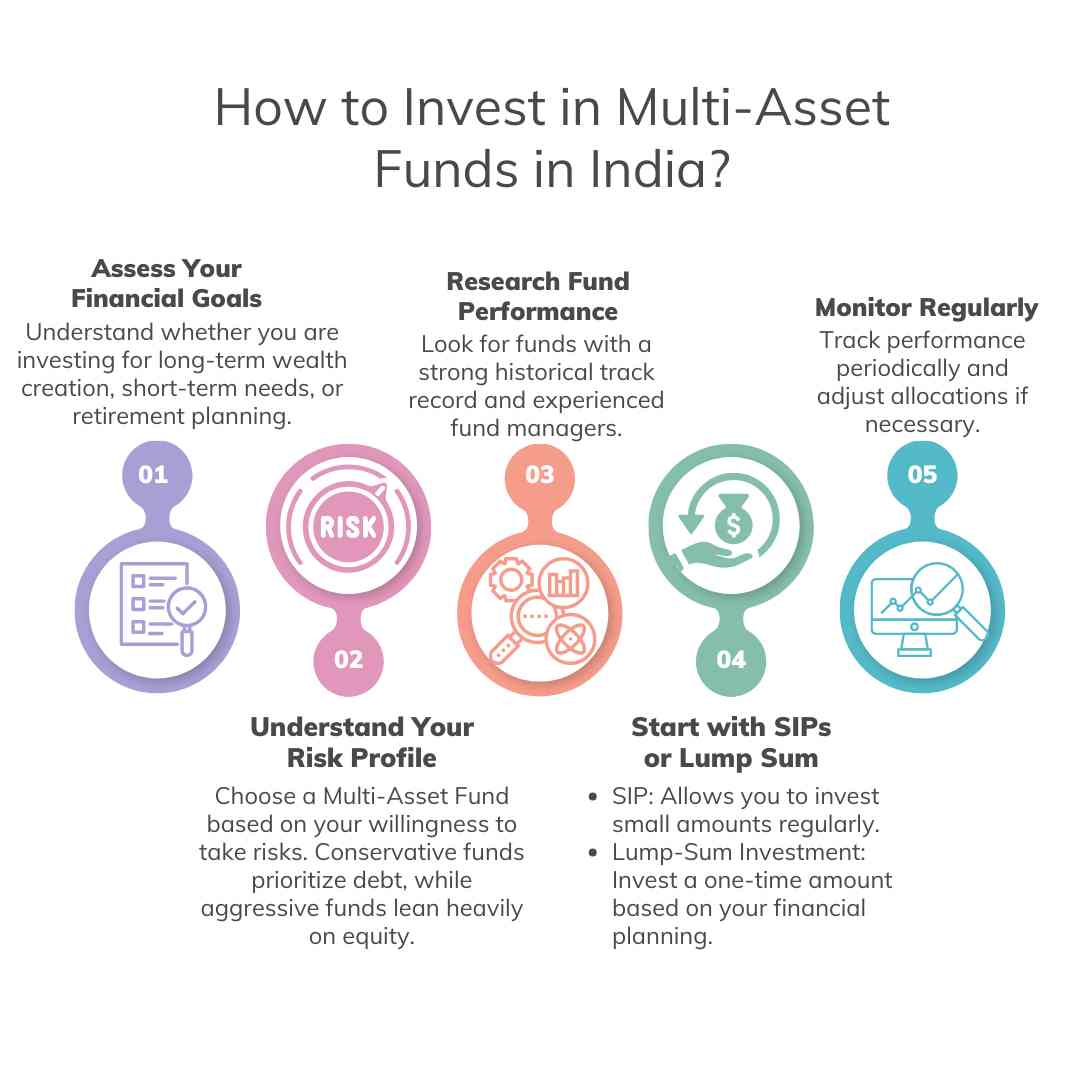

How to Invest in Multi-Asset Funds in India?

Investing in Multi-Asset Funds is straightforward. Follow these steps:

Conclusion

Multi-asset funds are the perfect solution for Indian investors seeking diversification, professional management, and risk-adjusted returns. They simplify investment strategies by combining equity, debt, commodities, gold, and other assets into a single product.

Whether you’re a conservative investor looking for steady income or a young investor seeking long-term growth, Multi-Asset Funds can fit into varied financial goals.

With proper research and strategic planning, Multi-Asset Funds can be a powerful addition to any investment portfolio in India.

Thematic Funds in India: A Growing Trend in Investment!

30th January 2025

Are you investing in SIPs smartly ?

21st January 2025

Multi-Cap vs Flexi-Cap Mutual Funds: Where to Invest in 2024?

26th September 2024

A Comprehensive Guide to NFO: New Fund Offer

12th September 2024