Navigating the Rise of Green Energy Investments in India: A Sustainable Wealth-Building Opportunity

28th November 2024 | Author : Centricity

India has made significant strides in sustainable development in recent years, particularly emphasising green energy. As the country battles high pollution levels and growing energy demands, there is a robust push toward renewable energy sources, such as solar, wind, and hydroelectric power. This shift aligns with global trends, making green energy investments not only environmentally responsible but also financially promising. For Indian investors, green energy offers a dynamic new asset class, balancing profitability with sustainability.

In this article, we’ll explore the rise of green energy investments in India, analyze the factors driving this growth, assess its financial potential, and offer insights on how individual investors can tap into this burgeoning sector.

Understanding the Green Energy Landscape in India

India is currently the world’s third-largest emitter of greenhouse gases, making the transition to green energy crucial. The government has been proactive in encouraging green energy development, setting ambitious targets to reach 450 gigawatts of renewable energy capacity by 2030. This agenda supports a range of sectors, including:

Each of these sectors provides ample investment opportunity, with both the public and private sectors actively involved in expanding India’s green energy capacity.

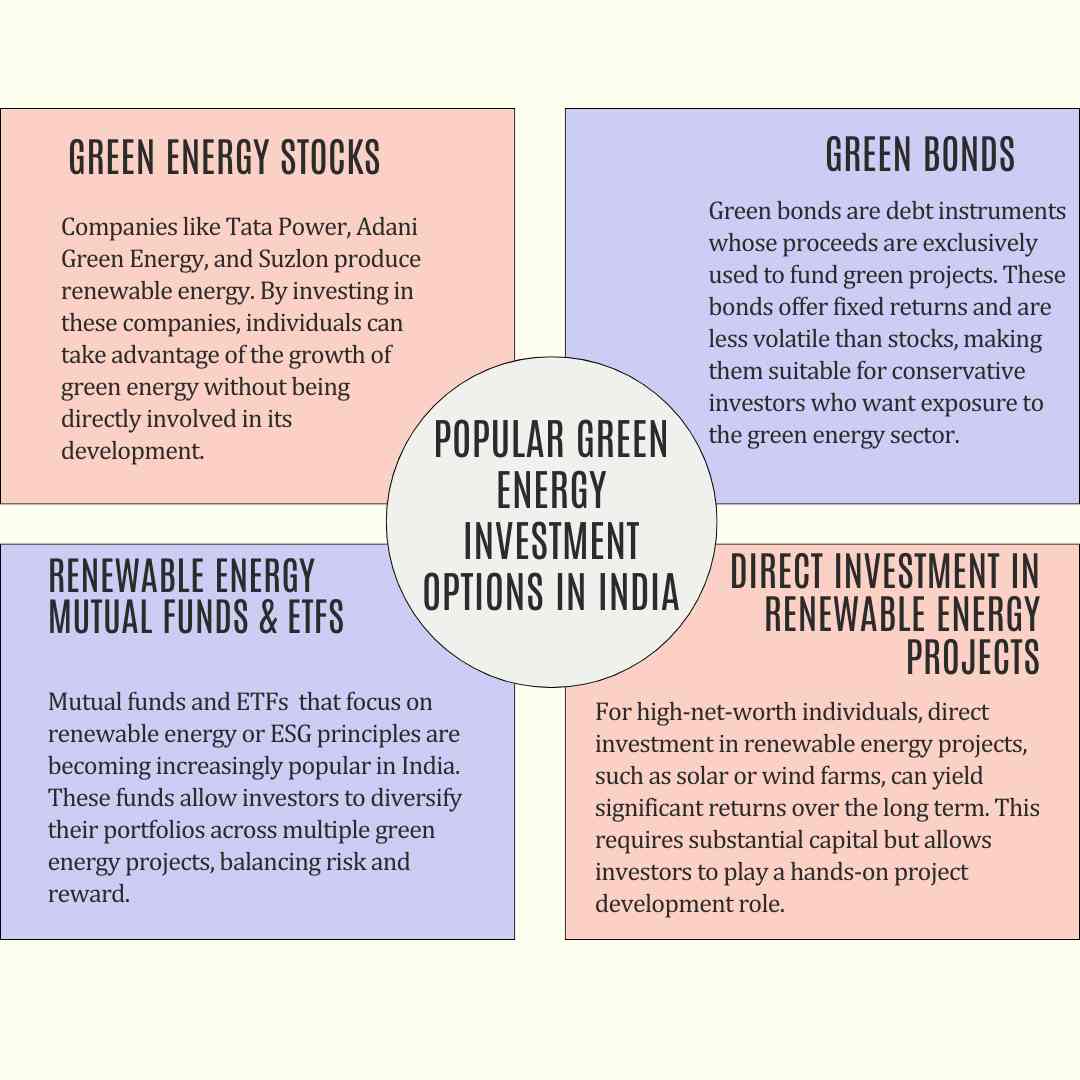

Why Green Energy Is Attracting Investors?

Several factors are driving investor interest in India’s green energy sector:

a) Government Initiatives and Policy Support

The Indian government offers incentives for renewable energy projects, including subsidies, tax benefits, and long-term power purchase agreements (PPAs) that reduce financial risk for investors. These policies are designed to attract domestic and foreign investment, create jobs, and ensure energy security.

b) Growing Global Focus on ESG Investments

Environmental, Social, and Governance (ESG) criteria have become an important investment consideration worldwide. Green energy aligns with ESG values, making it attractive to institutional investors who want to support sustainable projects.

c) Potential for High Returns

Although green energy investments require significant capital, they offer the potential for stable returns due to long-term energy demand growth and government-backed guarantees. As technology improves and costs decrease, green energy becomes more economically viable and profitable.

d) Climate Resilience and Environmental Impact

Beyond financial returns, green energy offers the benefit of reducing India’s reliance on fossil fuels, which are subject to price fluctuations. This sector also has a positive impact on climate resilience, a priority for investors looking to make responsible choices that align with a sustainable future.

Risks and Challenges in Green Energy Investment

Despite the promising growth of green energy, there are challenges investors should consider:

● Regulatory Risks: Policies and incentives are crucial to the sector’s growth, and any regulatory changes can impact profitability.

● High Initial Costs: Renewable energy projects often require substantial capital, which can be a barrier for smaller investors.

● Technological Risks: The fast-paced nature of technology in the green energy sector can render certain technologies outdated, impacting investments tied to those technologies.

● Operational Risks: Renewable energy projects can face operational challenges due to reliance on natural resources, such as sun availability or wind patterns.

While these risks exist, many of them can be mitigated by diversifying investments and focusing on established companies or funds with a history of stability in the sector.

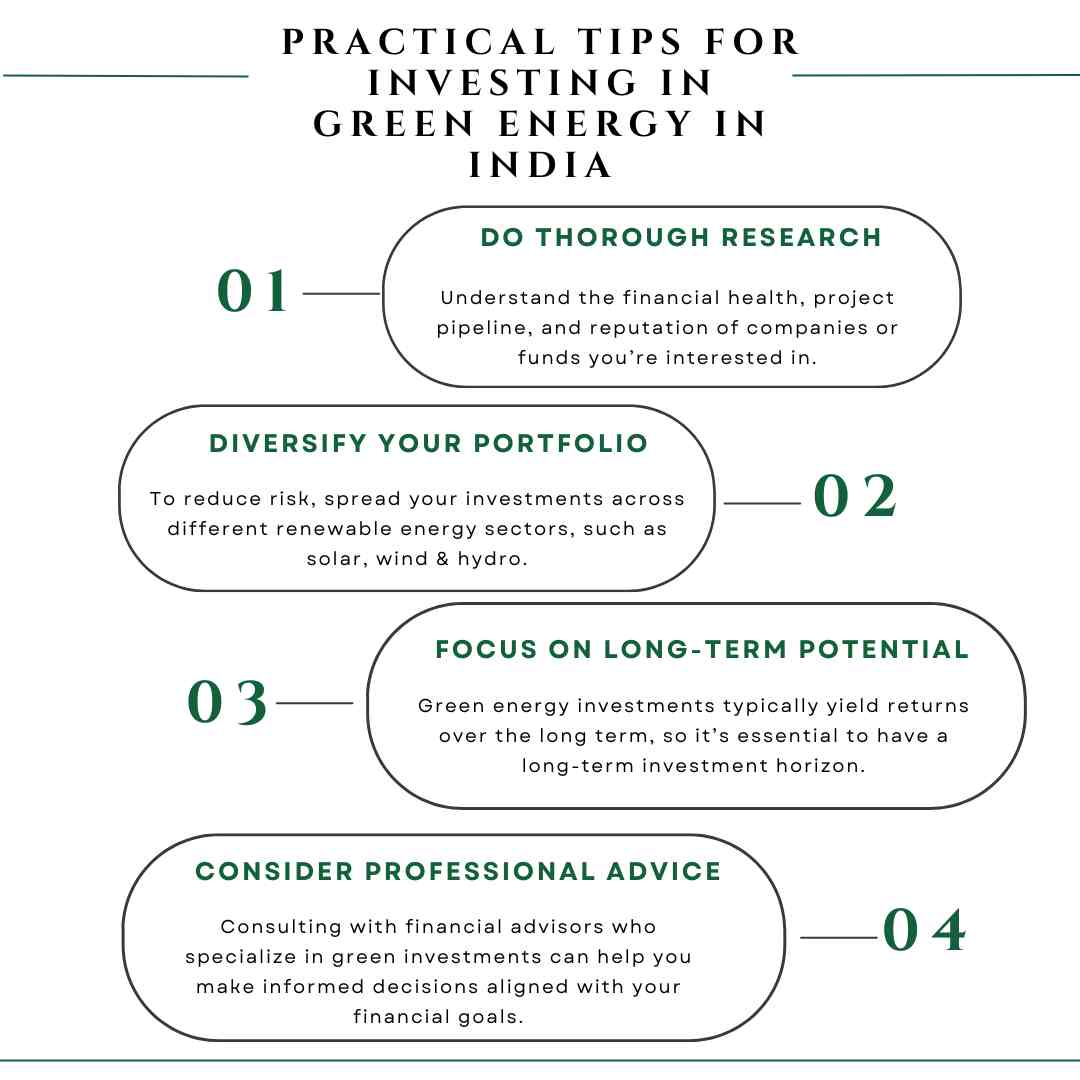

Practical Tips for Investing in Green Energy in India

Here are some actionable tips for those looking to invest in green energy:

Conclusion: Green Energy as a Path to Sustainable Wealth

India’s green energy sector offers promising investment opportunities that align with both financial goals and environmental responsibility. As the government continues to back renewable energy projects, and global investors prioritize sustainability, the sector is likely to grow substantially in the coming years.

For Indian investors, green energy represents a dual opportunity to achieve sustainable wealth and contribute to a cleaner, greener future.

With the right approach and understanding of the market, green energy investments can become a valuable addition to any Indian investor's portfolio. It’s a chance to make a positive impact while building wealth—a win-win proposition that few sectors can offer in today’s dynamic economic landscape.

Disclaimer: The above content should be used for informative purposes only. Equity investments are subject to market risk. Please consult your financial advisor before making any investment decisions.

Arbitrage Funds: A Safe Haven or a Strategic Investment?

26th December 2024

Why Index Funds Are Gaining Popularity in India?

5th September 2024

How to Avoid Making Poor Investment Decisions?

16th August 2024