Investing in SIPs During Diwali: A Festive Boost to Your Financial Future!

10th October 2024 | Author : Centricity

As Diwali, the festival of lights, approaches, it’s not just a time for celebration but also for making crucial financial decisions. For many Indians, this festive season is synonymous with starting new ventures, purchasing gold, or making significant investments. However, one of the most prudent financial steps you can take this Diwali is starting a Systematic Investment Plan (SIP) in mutual funds.

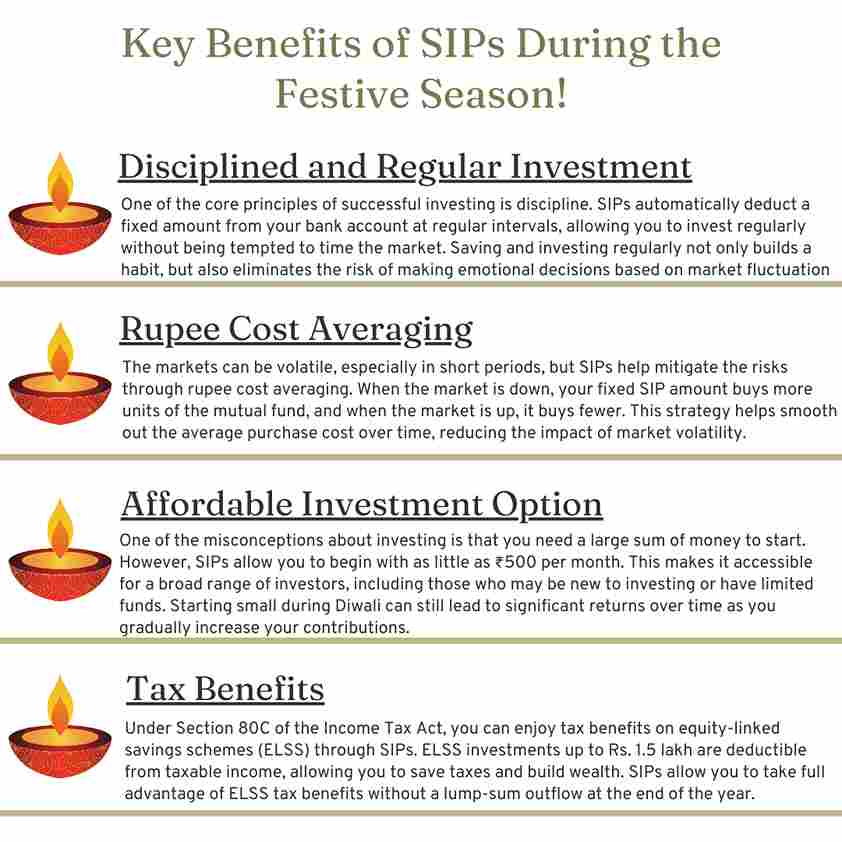

A SIP allows you to invest a fixed amount regularly in a mutual fund, helping you build wealth over time. It’s a disciplined, convenient way to invest, and starting an SIP during Diwali has many potential benefits. In this article, we'll explore how investing in SIPs during the festive season can lead to long-term financial growth, tax benefits, and peace of mind.

The Emotional and Financial Peace with SIPs

Festivals like Diwali aren’t just about material gains; they’re about securing long-term well-being for yourself and your family. A SIP helps you achieve financial security with peace of mind.

Because it’s a disciplined investment vehicle, you don’t have to constantly monitor the markets or worry about timing your investments. You simply commit to a consistent investment schedule, and over time,

you’ll see the rewards.

Why is Diwali a good time to start SIP investments?

1. New Beginnings and Financial Prosperity:

Diwali is traditionally associated with prosperity and growth, and many people use this auspicious period to start new financial ventures.

According to Hindu culture, Diwali is considered an ideal time to make investments, whether it’s in property, gold, or the stock market. Starting an SIP during this season aligns well with the idea of new beginnings, giving you a psychological boost and commitment to long-term financial growth.

2. Market Trends and Seasonal Gains:

Historically, the stock market has performed well during Diwali. The last quarter of the year often sees market indices rally due to various factors, such as increased consumer spending, higher corporate earnings, and overall festive optimism.

By investing in SIPs during Diwali, you can potentially benefit from these market trends. While SIPs are long-term investments and not tied to short-term gains, starting during a market upswing can give your portfolio a positive start.

3. Compounding Returns

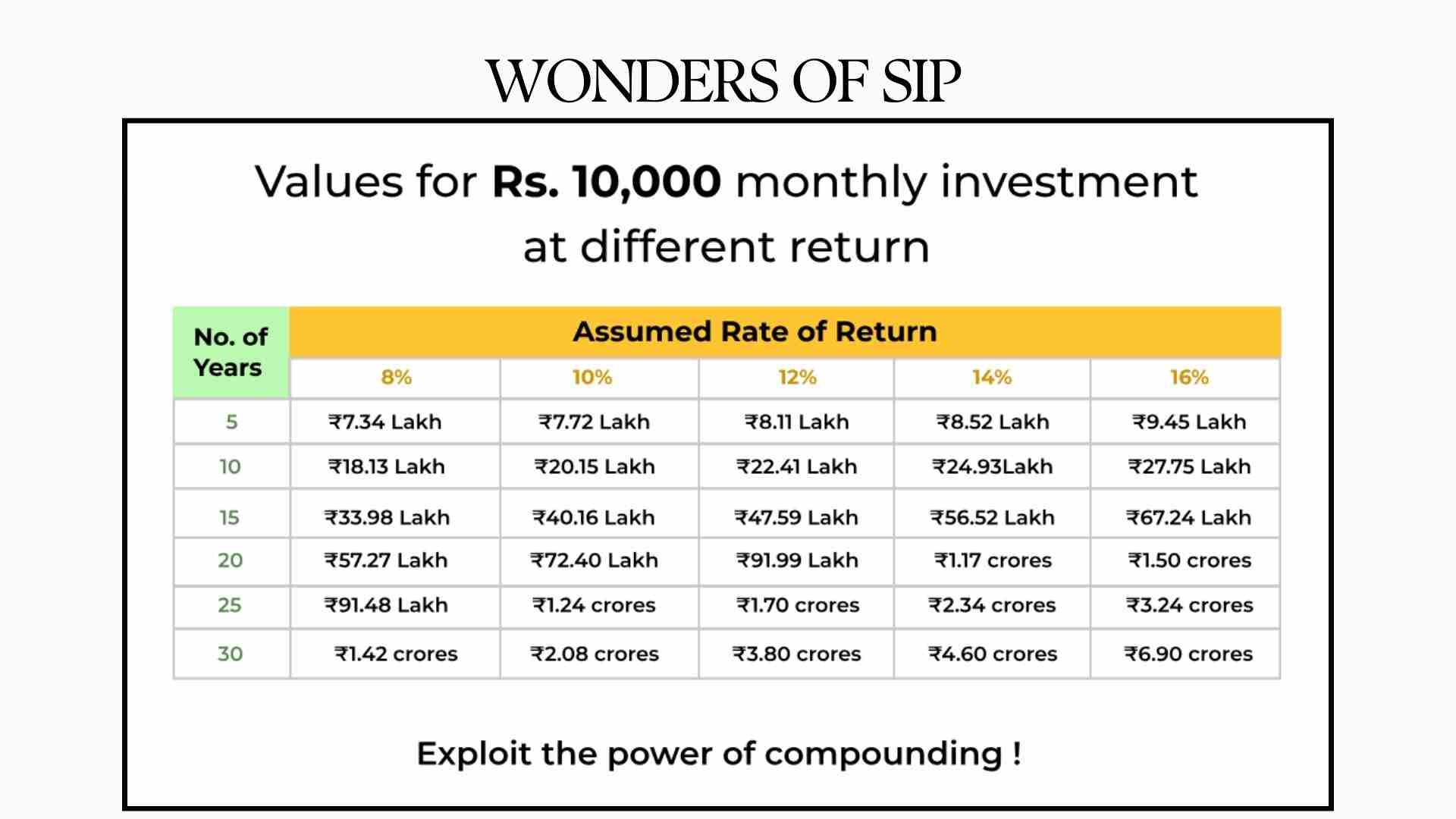

One of the greatest advantages of SIPs is compounding, where the returns generated on your investments start generating their returns. The earlier you start investing, the more time your money has to grow.

By beginning your SIP during Diwali, you’re giving your investments a head start. Even small, consistent investments like 10,000rs can also help you accumulate significant wealth over time thanks to the power of compounding.

How to Maximize SIP Investments During Diwali?

1. Set Clear Financial Goals

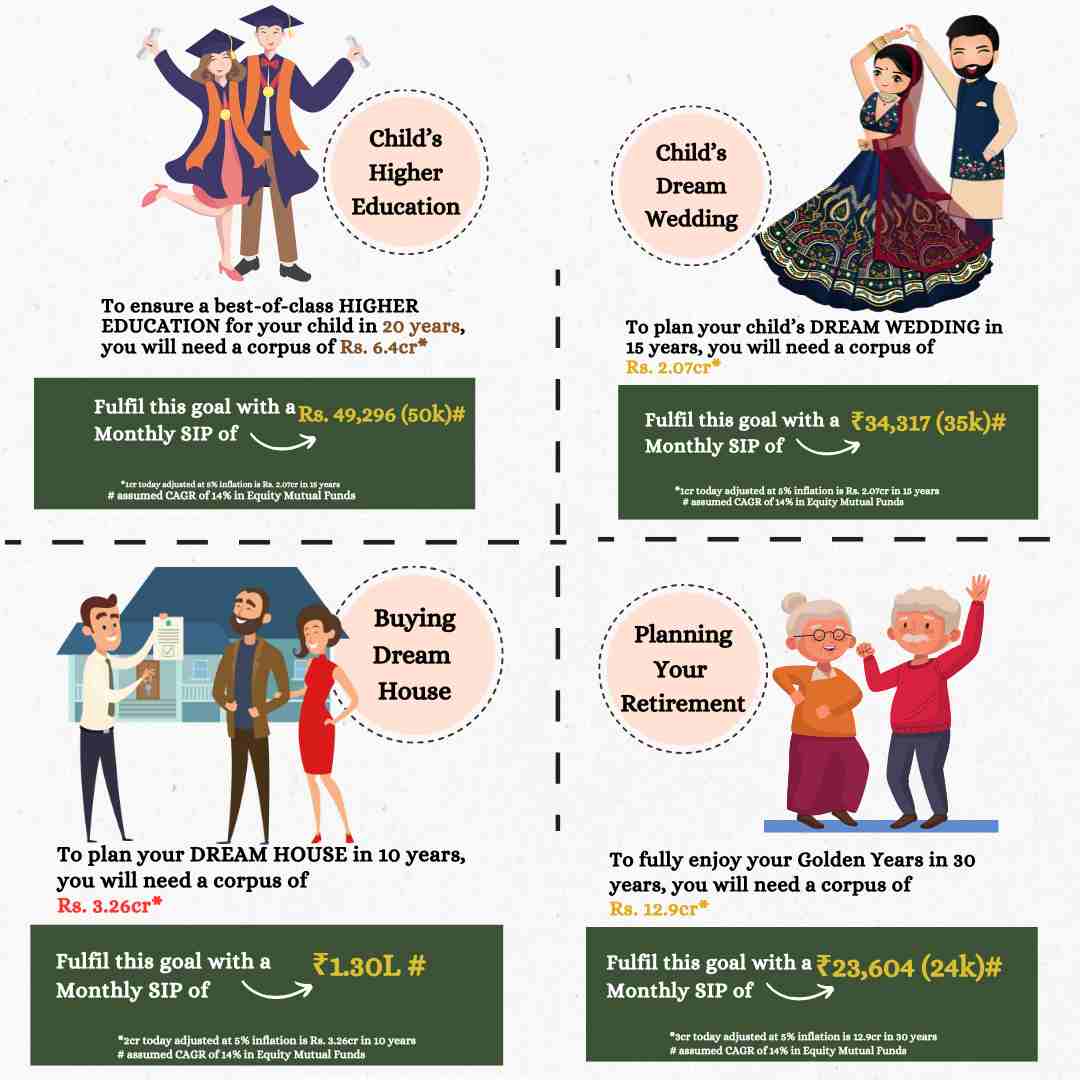

Before starting your SIP, it’s important to define your financial goals. Whether it’s saving for a child’s education, buying a home, or planning for retirement, having a clear objective will help you choose the right mutual fund.

Diwali is a great time to reflect on your future financial needs and set both short-term and long-term goals.

2. Choose the Right Mutual Fund

With a wide variety of mutual funds available, selecting the right one for your SIP is crucial. Equity mutual funds tend to offer higher returns but come with greater risk, while debt funds are more conservative but offer lower returns.

A balanced or hybrid fund can offer a mix of both. Consulting a financial advisor or doing thorough research can help you make the right choice based on your risk appetite and goals.

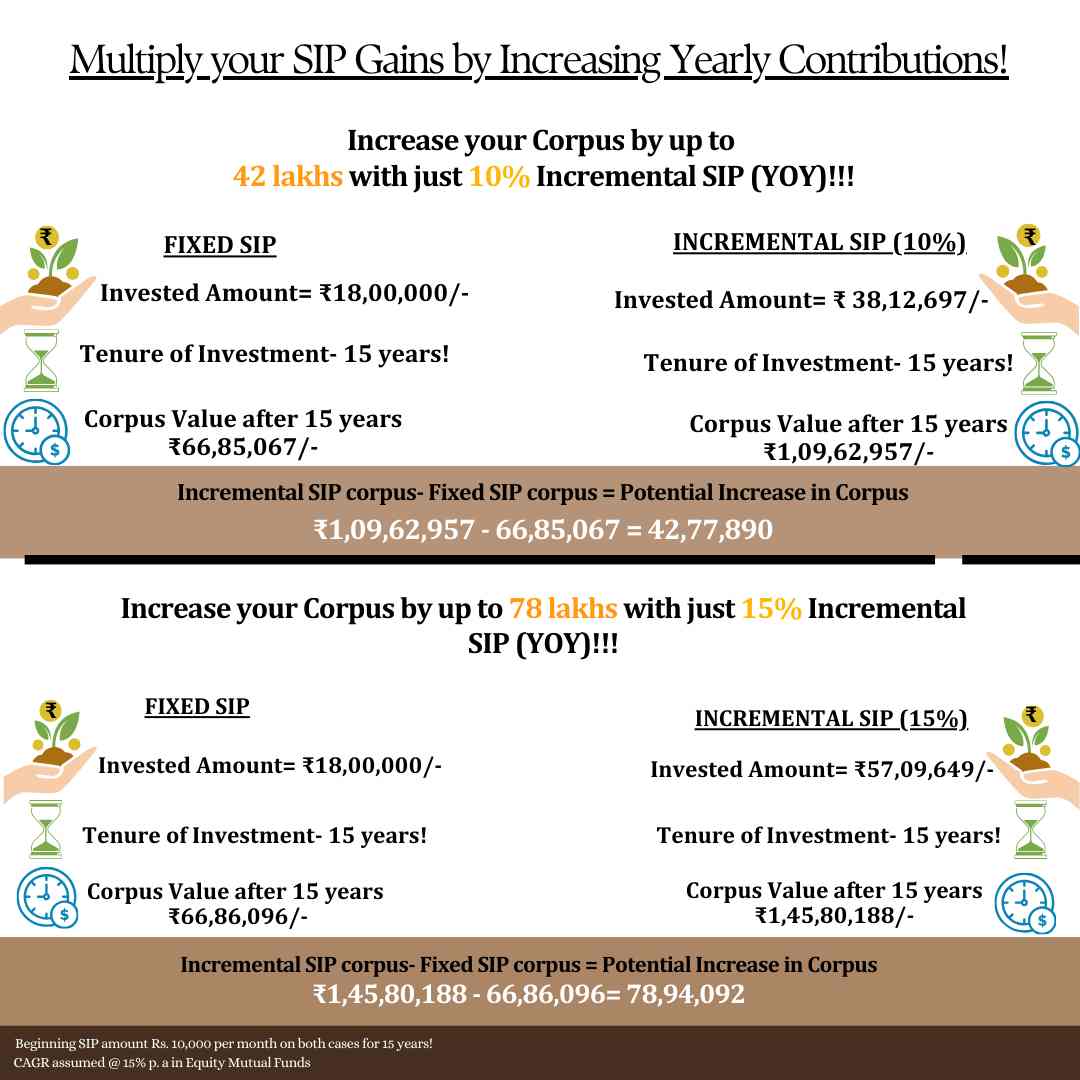

3. Increase SIP Contributions Annually

As your income grows, consider increasing your SIP contributions each year. This simple step can significantly boost your long-term returns. Many mutual funds offer a feature called SIP Top-up, which allows you to automatically increase your SIP amount annually.

Diwali is a good time to review your financial situation and commit to growing your investments. It helps to-

● Meet your financial goals faster

● Builds wealth faster

● Adapts to rising income

● Automatic route to increased savings!

Conclusion

Investing in SIPs during Diwali is a smart, disciplined, and accessible way to secure your financial future. The festive season, with its focus on new beginnings and prosperity, provides the perfect backdrop for starting your investment journey. Whether you’re a seasoned investor or a beginner, the benefits of SIPs—compounding, rupee cost averaging, affordability, and tax savings—can set you on the path to wealth creation.

So this Diwali, as you celebrate with lights, sweets, and family, consider giving yourself the gift of financial security through SIP investments. It’s a decision that could brighten your financial future for years to come.

Thematic Funds in India: A Growing Trend in Investment!

30th January 2025

Are you investing in SIPs smartly ?

21st January 2025

Multi-Asset Funds in India: Diversification Made Easy for Investors

16th December 2024

Multi-Cap vs Flexi-Cap Mutual Funds: Where to Invest in 2024?

26th September 2024

A Comprehensive Guide to NFO: New Fund Offer

12th September 2024