Things to consider when Transferring Shares From One Demat Account to Another!

21st May 2024 | Author : Centricity

Mastering share transfers is one of the most crucial aspects of portfolio management. Investing and trading in India has been revolutionized by dematerialised (Demat) accounts, which replaced physical share certificates with electronic records. In electronic form, these accounts are held with registered depository participants (DPs).

Advantages of Transferring Shares from one account to another!

1. The consolidation of holdings

Transferring shares between demat accounts enables shareholders to combine their holdings into a single account. You can quickly and successfully track all of your investments.

2. Facilitates ownership changes

The transfer of shares across demat accounts is critical for simplifying ownership transitions. For example, if you want to give your son some shares when he becomes 20, the transfer of shares ensures a smooth transition of ownership.

Aside from this, share transfers help to simplify corporate actions such as mergers and demergers

3. Convenience and Security

Electronic share transfers using demat accounts provide convenience and increased security. They eliminate the need for physical certificates and documentation, allowing shareholders to conveniently initiate and monitor transfers online. This eliminates administrative overhead while improving transaction security.

4. Regulatory Compliance

Share transfers between demat accounts adhere to regulatory rules. This ensures that transactions are transparent and legal.

5. Improved Portfolio Management

Consolidating shares into a single demat account increases portfolio management efficiency. Shareholders can better analyze their entire investment portfolio.

What are the Types of Transfer?

- Intra-Depository Transfer: This occurs when both the sender and receiver accounts have the same depository (NSDL or CDSL).

- Inter-Depository Transfer: This involves transferring shares between accounts held with different depositories (one in NSDL and the other in CDSL).

What are the Types of Methods used for transferring shares?

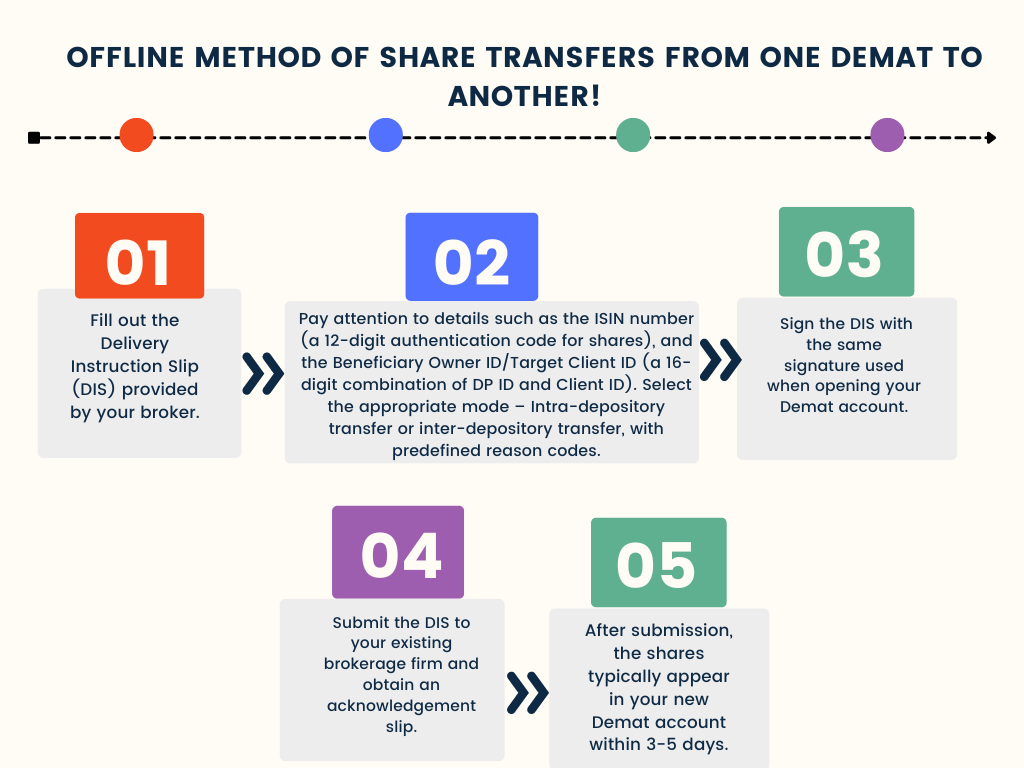

1. Manual/ Offline Transfer:

This requires filling out a Delivery Instruction Slip (DIS), similar to a bank chequebook. The DIS must be filled out with accurate details of the securities and submitted to the existing depository participant (DP).

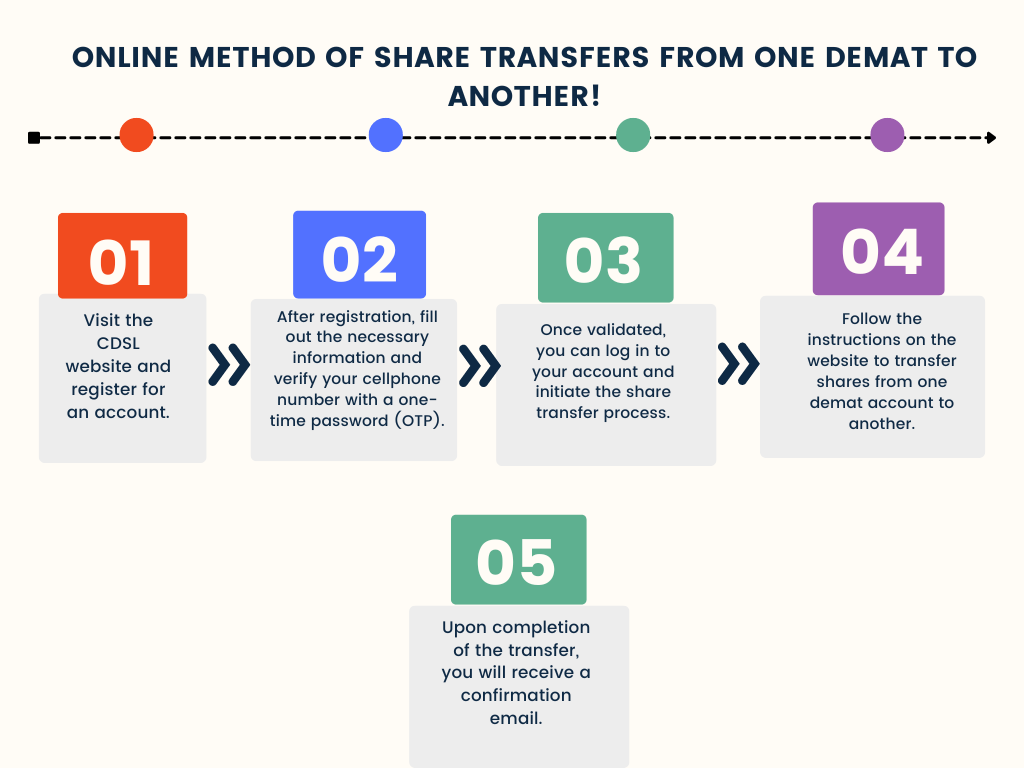

2. Online Transfer:

Some DPs provide an electronic transfer facility, which can be more convenient and quicker. This requires both DPs to be enabled for online transfer through systems like Speed-e (NSDL) or Easiest (CDSL).

What documents and details are required?

- DIS Slip: Ensure all details such as ISIN, quantity, DP ID, client ID of the recipient, and other necessary fields are accurately filled.

- Verification: Signatures on the DIS must match those recorded with the DP. Incorrect or mismatched signatures can delay the process.

- Acknowledgement: Obtain a receipt or acknowledgement from the DP upon submission of the DIS

What is the standard transfer time?

Generally, the transfer is processed within 3-5 business days. However, delays can occur due to discrepancies or errors in the DIS.

FEW THINGS TO CONSIDER BEFORE MAKING TRANSFERRING SHARES FROM ONE DEMAT TO ANOTHER!

- Ensure that both Demat accounts (sender and recipient) are active and not frozen or dormant.

- Confirm that the holdings in the sender’s account are adequate and not pledged or locked in.

- After the transfer, verify that the shares have been credited to the new Demat account. This can be done through a holding statement or an online account summary.

- Notify both the existing and new brokers about the transfer to avoid any discrepancies or misunderstandings.

- Your broker or Depository Participant (DP) may charge you fees for facilitating the transfer of shares. Brokerage policies and the type of transfer (intra-depository, inter-depository, or off-market) determine these fees.

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented under our newsletter and blogs is solely for informational purpose.

Thematic Funds in India: A Growing Trend in Investment!

30th January 2025

Are you investing in SIPs smartly ?

21st January 2025

Multi-Asset Funds in India: Diversification Made Easy for Investors

16th December 2024

Multi-Cap vs Flexi-Cap Mutual Funds: Where to Invest in 2024?

26th September 2024