A Comprehensive Guide to NFO: New Fund Offer

12th September 2024 | Author : Centricity

Mutual funds have become a popular investment avenue in India, providing investors with a diversified and professionally managed portfolio. A New Fund Offer (NFO) often garners significant attention among the various mutual fund options available.

NFOs represent the first-time subscription of a new mutual fund scheme by an Asset Management Company (AMC). While they can offer unique opportunities, understanding their intricacies is crucial before investing.

This article will explore NFOs, their types, benefits, and the key considerations for Indian investors.

What is an NFO?

A New Fund Offer (NFO) is the initial offering of units in a new mutual fund scheme launched by an AMC. Much like an Initial Public Offering (IPO) for stocks, an NFO is designed to raise funds to invest according to the scheme's stated objectives. During the NFO period, units are typically available at a nominal price, usually ₹10, making it an attractive proposition for investors looking to buy in early. However, an NFO should not be confused with a low-cost entry point; its performance depends on several other factors.

Benefits of Investing in NFOs

Investing in NFOs can be advantageous under the right circumstances. Here are some potential benefits:

● Opportunity for Diversification:

NFOs often introduce new themes or investment strategies that might not be available in existing funds. This provides investors with an opportunity to diversify their portfolios by adding unique assets or sectors.

● Cost Efficiency:

NFOs are typically launched at a lower price point (usually ₹10 per unit), allowing investors to enter at a potentially low cost. However, it's important to note that the entry price does not necessarily guarantee lower risk or higher returns.

● Potential for Higher Returns:

If the fund manager’s strategy aligns well with market conditions, NFOs can deliver higher returns, especially if launched during favourable market conditions.

● Professional Management:

NFOs, like other mutual funds, are managed by professional fund managers with expertise in asset management. They use their knowledge and market insights to make informed decisions and optimize the fund's performance.

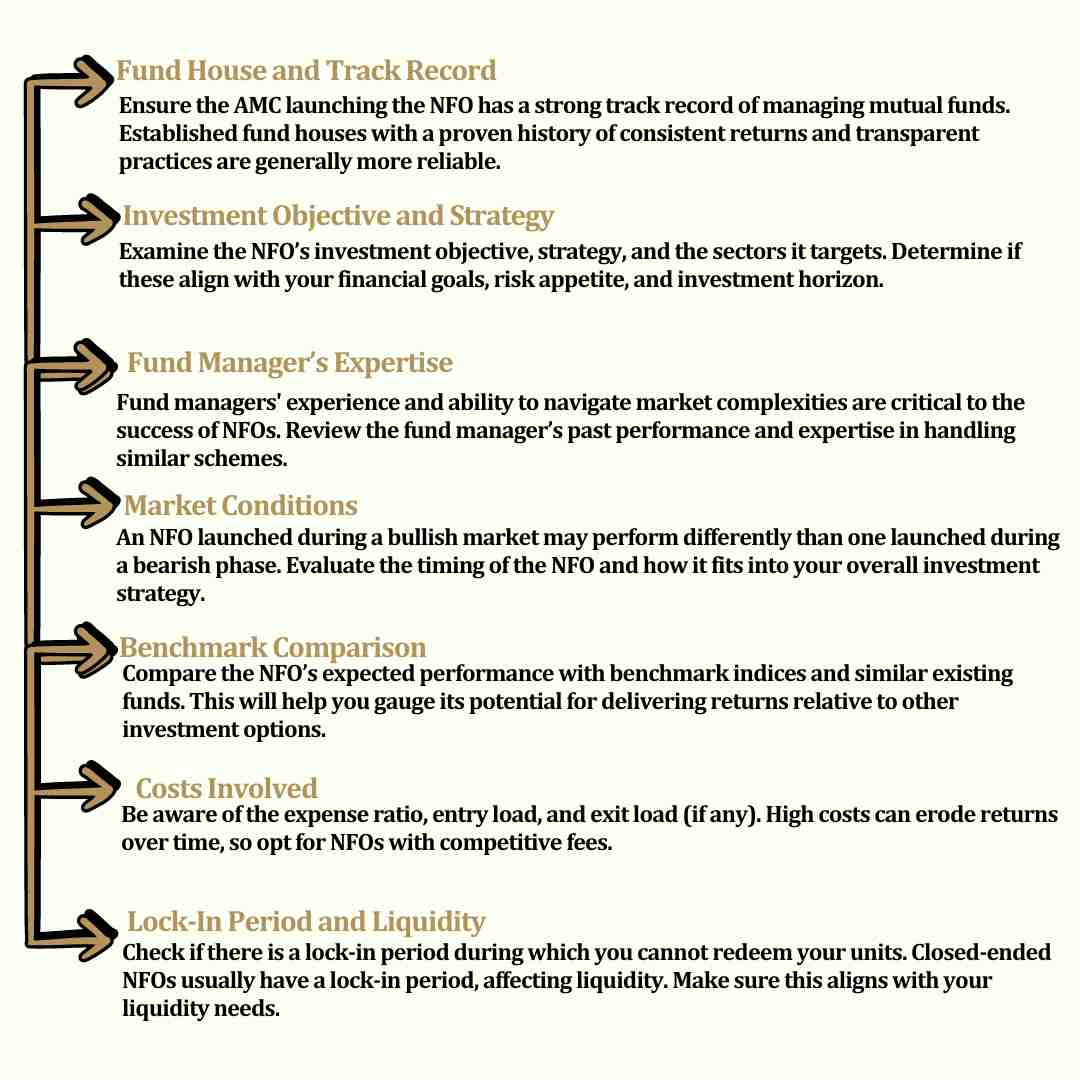

Key Considerations Before Investing in an NFO

Investing in NFOs can be a rewarding opportunity for investors looking to diversify their portfolios or enter new market segments. However, it is essential to perform thorough due diligence, understand the risks, and ensure that the NFO aligns with your investment goals and risk profile.

While NFOs can offer a fresh and innovative approach to mutual fund investing, they should not be viewed solely as a low-cost entry into the market.

Instead, consider them as one of many tools in your investment strategy, selected based on careful research and consideration.

Disclaimer: The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented in our newsletter and blogs is solely for informational purposes!

Thematic Funds in India: A Growing Trend in Investment!

30th January 2025

Are you investing in SIPs smartly ?

21st January 2025

Multi-Asset Funds in India: Diversification Made Easy for Investors

16th December 2024

Multi-Cap vs Flexi-Cap Mutual Funds: Where to Invest in 2024?

26th September 2024