Accredited Investors: Who are they?

19th June 2024 | Author : Centricity

In the world of investments, new policies or changes are always on the route of advancing. The accredited investor framework was introduced into the Indian securities market in August 2021 in an effort to open up investment options for affluent investors.

Traditionally, sophisticated investment was reserved for institutions, family offices, and ultra-high-net-worth investors. An emerging wave, however, will democratize access to unique investment opportunities and allow individual investors to take charge of their financial futures.

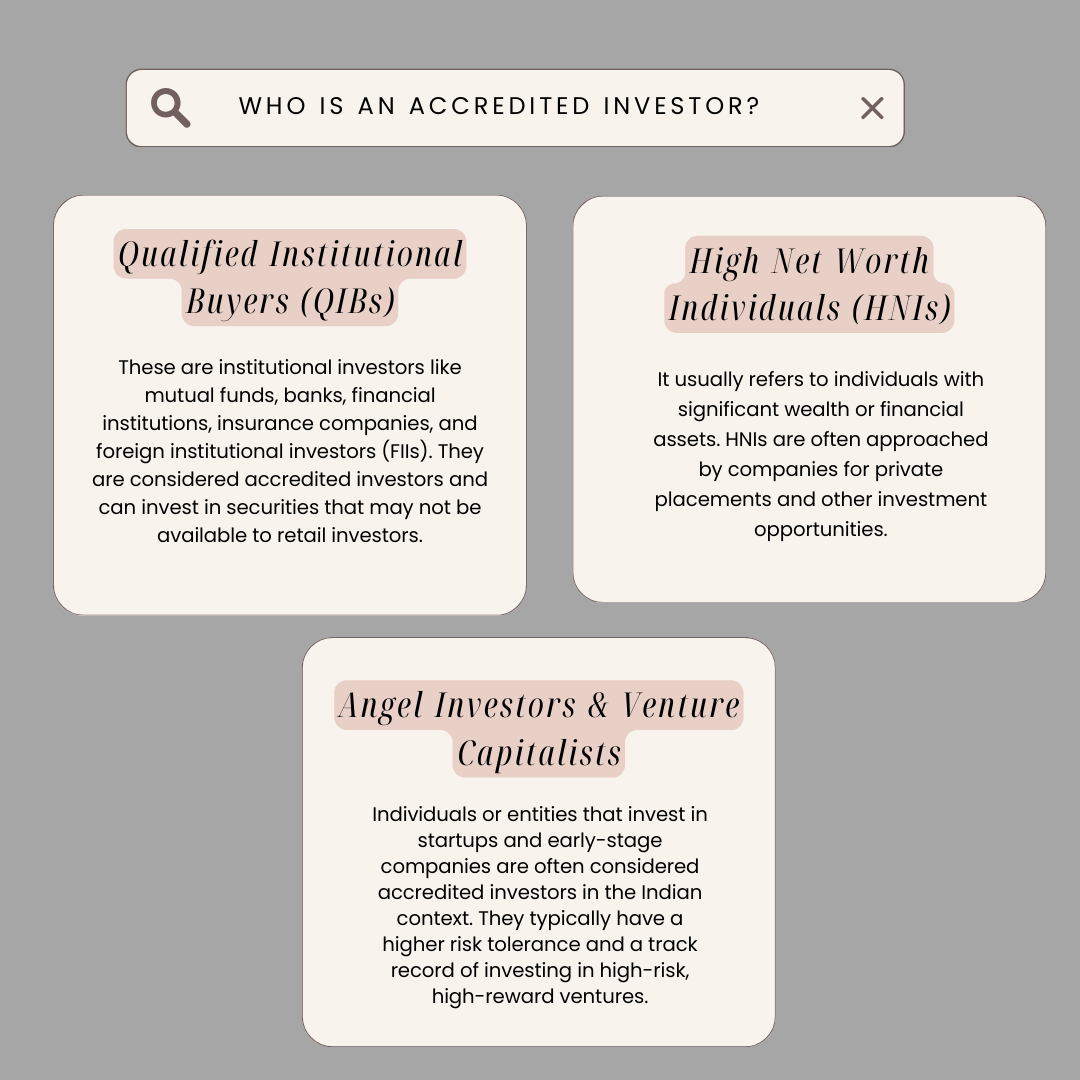

Who is an Accredited Investor?

Accredited investors are individuals or entities permitted to invest in securities not registered with financial authorities. Their financial sophistication reduces their need for regulatory disclosure filings that provide protection. The concept of accredited investors aims to facilitate investments in high-risk, high-reward opportunities by those who can bear potential losses.

Who is considered an accredited investor by SEBI?

SEBI defines accredited investors as institutions or business entities with a net worth of Rs 25 crore or more that trade securities through private placement. A person's liquid worth must exceed Rs 5 crore and their gross income must exceed Rs 50 lakh a year to qualify as an accredited investor.

To be called an accredited investor, an entity must adhere to certain requirements. You must be financially stable to absorb the risk of losing capital on unregistered investments. The majority of accredited investors have at least some experience and a profitable portfolio.

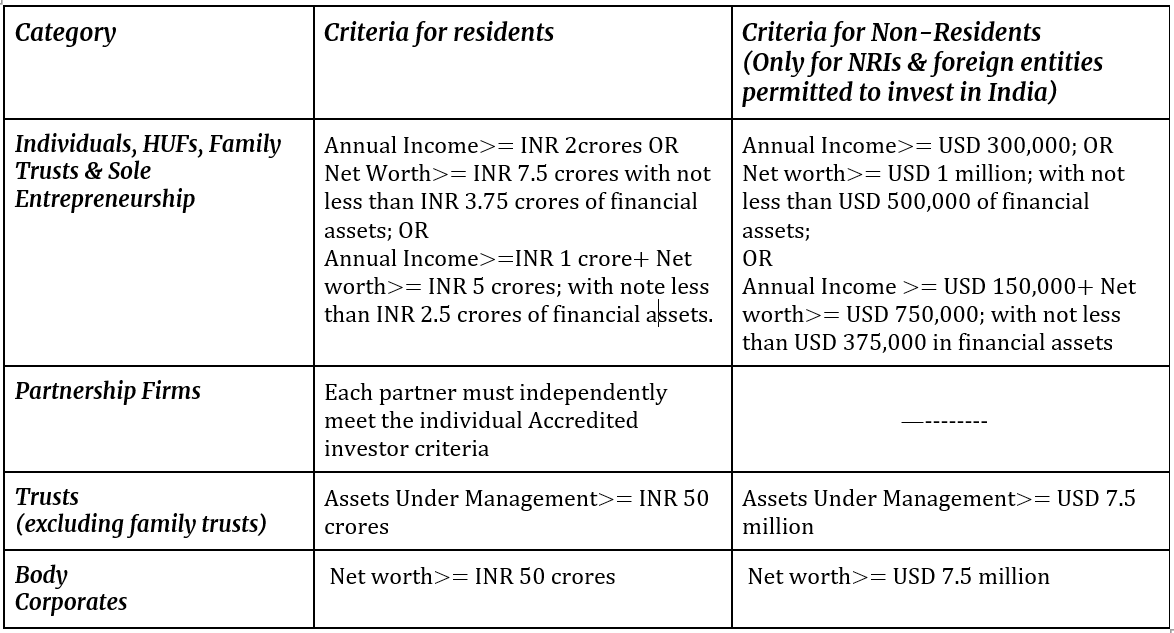

SEBI's criteria for accredited investors: what are they?

Accredited Investor Benefits: What are they?

1. Access to Exclusive Investment Opportunities:

● Participation in private equity, venture capital, and hedge funds.

● Investment in start-ups and unlisted companies with high growth potential.

2. Reduced Regulatory Constraints:

● Fewer regulatory requirements compared to public investments, allowing for more flexible investment strategies.

3. Potential for High Returns:

● Opportunities to invest in high-risk ventures that offer the potential for substantial returns.

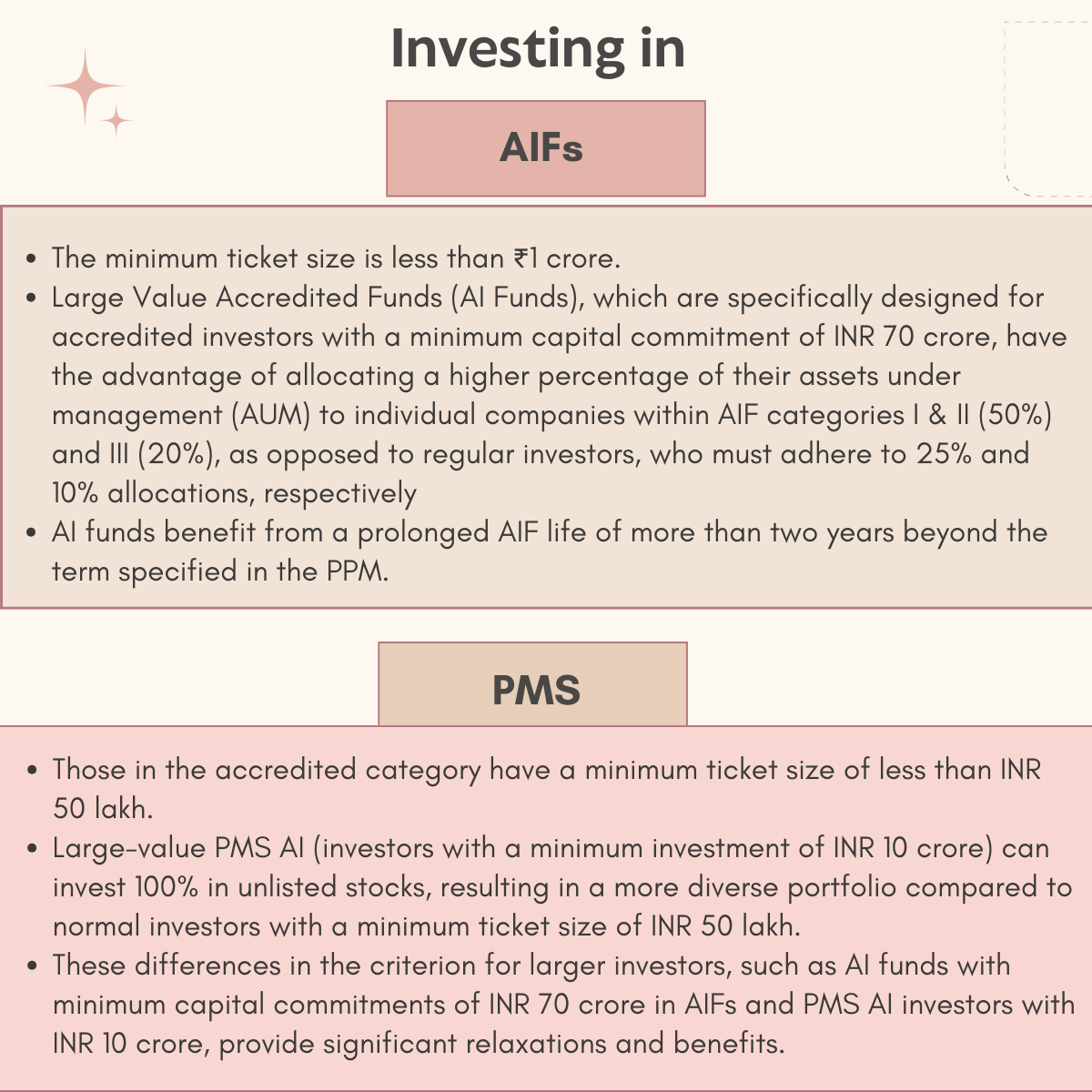

Following are the benefits that investors can avail when investing in different investment options like AIF (Alternate Investment Funds) or PMS (Portfolio Management Services):

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented under our newsletter and blogs is solely for informational purpose.

Arbitrage Funds: A Safe Haven or a Strategic Investment?

26th December 2024

Why Index Funds Are Gaining Popularity in India?

5th September 2024

How to Avoid Making Poor Investment Decisions?

16th August 2024