Why Index Funds Are Gaining Popularity in India?

5th September 2024 | Author : Centricity

In recent years, the Indian mutual fund industry has experienced a paradigm shift. Among the many trends reshaping the sector, the rise of passive investing — particularly through index funds — has garnered significant attention. Traditionally, mutual fund investments in India were dominated by actively managed funds.

However, with growing awareness, changing investor preferences, and a dynamic market environment, index funds have emerged as a preferred choice for a broad spectrum of investors.

This article delves into the factors driving this shift, the benefits of index funds, their current performance in the Indian market, and the future of passive investing in India.

Understanding Passive Investing and Index Funds

To grasp the increasing popularity of index funds, it is essential first to understand the concept of passive investing. Unlike active investing, where fund managers actively pick stocks and attempt to outperform the market, passive investing aims to replicate the performance of a specific market index, such as the Nifty 50 or the Sensex.

An index fund is a type of mutual fund that mirrors a particular stock market index. It involves building a portfolio of stocks that matches the index's composition it aims to replicate.

For example, if an index fund tracks the Nifty 50, it will hold the same stocks proportionately as the Nifty 50 index. As a result, the fund's performance will closely track the index's performance, providing returns that are, by design, aligned with the broader market.

The Key Drivers Behind the Popularity of Index Funds in India

Current Market Scenario: How Are Index Funds Faring?

The Indian stock market has seen unprecedented growth in recent years, attracting a wave of new investors, particularly millennials and younger generations. In this vibrant market environment, index funds have demonstrated strong performance, often outpacing many actively managed funds. This trend can be attributed to several factors:

● Market Volatility and Economic Uncertainty:

In times of market volatility, such as during the COVID-19 pandemic or global economic uncertainty, actively managed funds may struggle to beat the benchmark due to higher costs and the challenges of stock selection. Index funds, however, tend to perform in line with the overall market, providing returns that mirror the broader economic environment. This resilience has made them a preferred choice for risk-averse investors seeking steady growth.

● Attractive Returns Over Time:

Despite periods of volatility, historical data shows that over the long term, index funds have delivered returns that often outperform the majority of actively managed funds, especially after considering fees and expenses. For instance, several index funds tracking the Nifty 50 or the Sensex have provided returns that match or exceed those of many actively managed equity funds in the same category.

● Increased Adoption by Institutional Investors:

The trend towards passive investing is not limited to retail investors. Institutional investors, including pension funds and insurance companies, are increasingly allocating more of their portfolios to index funds due to their cost-effectiveness, transparency, and predictable returns. This shift is further enhancing the credibility and appeal of index funds in the Indian market.

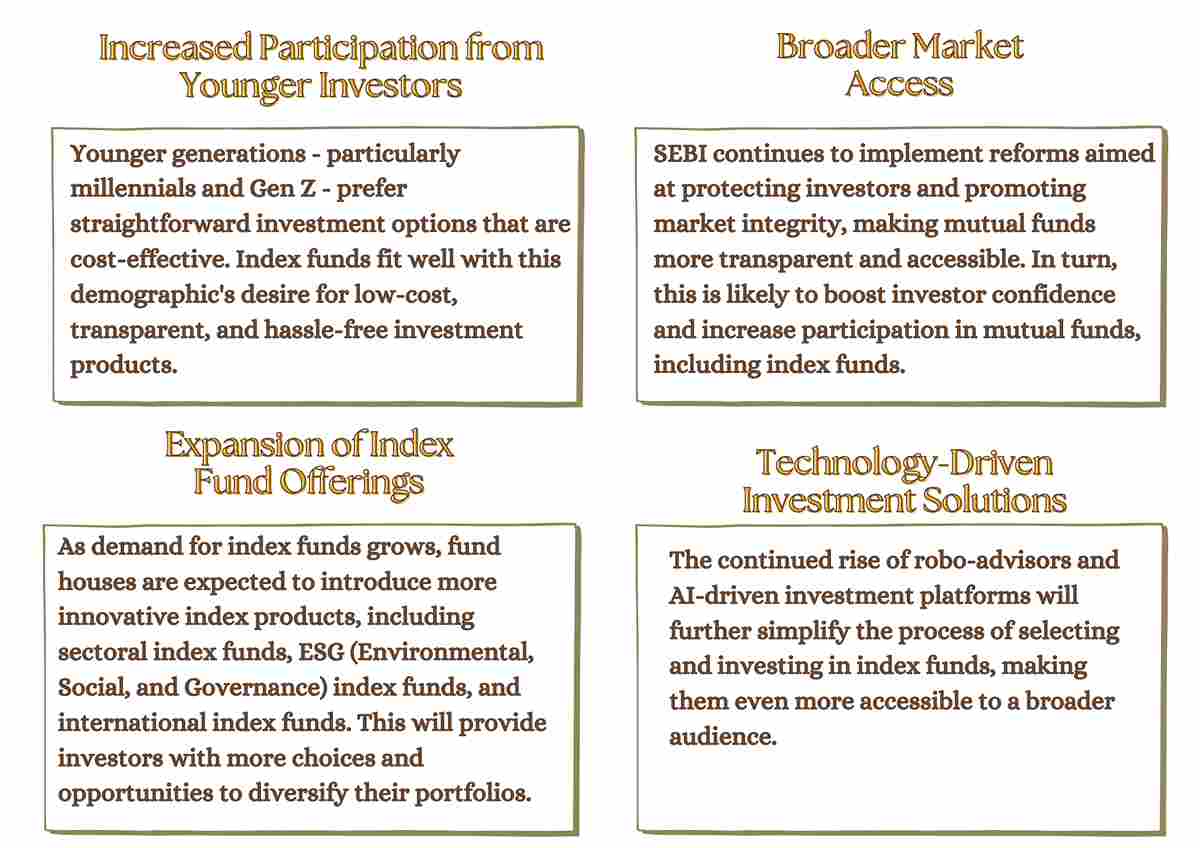

Future Prospects: What Lies Ahead for Index Funds in India?

The future of index funds in India looks promising, with several factors likely to drive continued growth:

With the ongoing democratization of financial markets and technological advancements making investing easier and more accessible, index funds are set to play an increasingly prominent role in India's mutual fund industry. Whether you are a new investor looking to dip your toes into the market or a seasoned investor seeking to diversify your portfolio, index funds provide a balanced and strategic avenue for wealth creation.

Arbitrage Funds: A Safe Haven or a Strategic Investment?

26th December 2024

How to Avoid Making Poor Investment Decisions?

16th August 2024