How can STP be a retirement planning tool?

4th June 2024 | Author : Centricity

Retirement planning is a crucial financial goal, necessitating strategic investments to ensure a steady income post-retirement. A Systematic Transfer Plan (STP) has emerged as an effective tool for retirement planning. STP allows investors to transfer a fixed amount from one mutual fund scheme to another regularly, balancing the risk and return.

What do you mean by a Systematic Transfer Plan (STP)?

An STP involves transferring money from one mutual fund scheme, typically a debt fund, to another, usually an equity fund, or vice versa. This is done systematically, either weekly, monthly, or quarterly. The primary objective is to mitigate risk and manage returns by leveraging the relative stability of debt funds and the growth potential of equity funds.

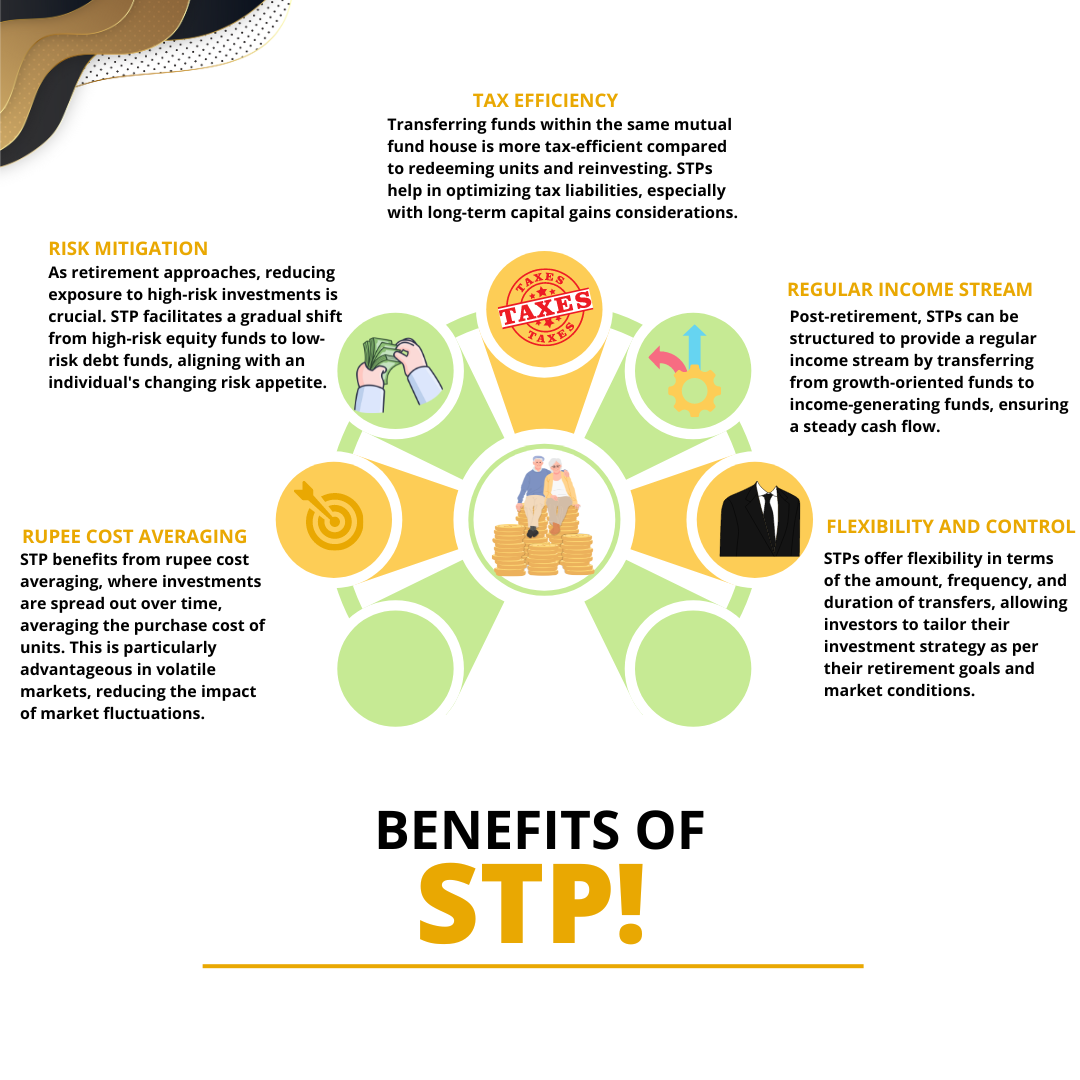

It is a versatile tool in retirement planning, offering risk management, tax efficiency, and a steady income stream.

Benefits of STP in Retirement Planning

Who Should Invest via Systematic Transfer Plans?

For those looking to invest a lump sum but are not ready to do so at once, STP is an excellent option. It could be because they are risk-averse and don't want to get entangled in market volatility. In general, they may also be wary of equities. Investing in liquid or debt funds is an option for such investors. This money is transferred to an equity fund where it receives both fixed returns from the debt funds and potential returns from the equity fund.

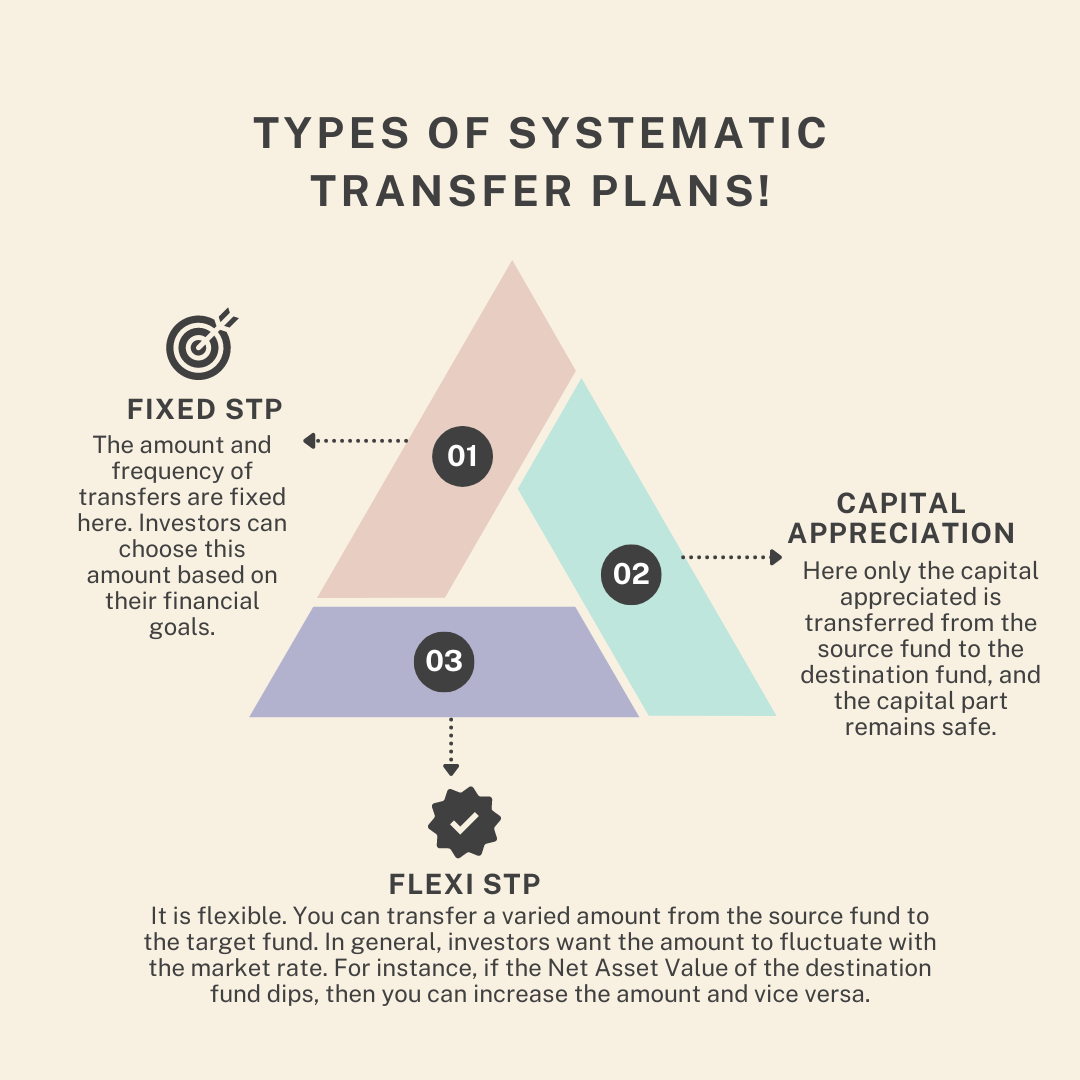

What are the Types of Systematic Transfer Plans?

How to start with STP?

1. Early Start: Begin STP investments early in your career to harness the power of compounding and build a substantial corpus over time.

2. Choose the Right Funds: Select a mix of equity and debt funds based on your risk tolerance, investment horizon, and retirement goals. Equity funds provide growth, while debt funds offer stability.

3. Regular Review and Adjustment: Periodically review your STP strategy and adjust the transfer amount and frequency based on market conditions and your financial situation.

4. Gradual Shift to Safety: As you near retirement, gradually increase the proportion of transfers to debt funds to secure your corpus against market volatility.

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented under our newsletter and blogs is solely for informational purpose.