P2P Lending in India: A Comprehensive Guide

28th August 2024 | Author : Centricity

Peer-to-peer or P2P lending has emerged as a significant alternative to traditional banking in India, offering both borrowers and lenders a unique platform for financial transactions. As the financial ecosystem evolves, P2P lending platforms have gained traction due to their ability to directly connect borrowers with lenders, providing opportunities for higher returns, increased transparency, and greater control over investments.

However, this innovative approach also comes with its own set of challenges and regulatory frameworks that both existing and potential investors need to understand.

This article delves into the intricacies of P2P lending in India, examining how it works, the regulatory landscape, and what investors should consider before participating in this market.

What is Peer-to-Peer (P2P) Lending?

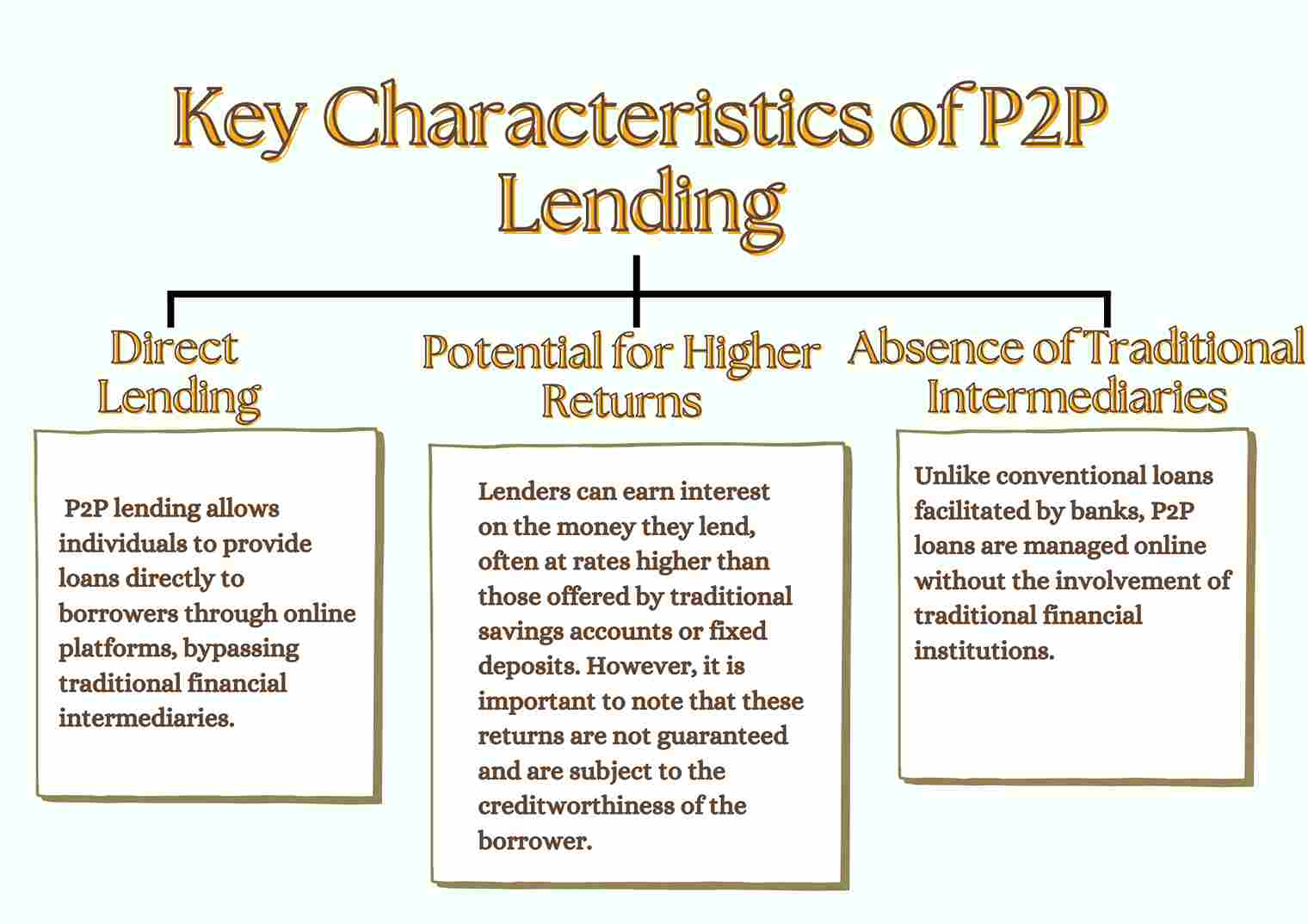

P2P lending is a method of debt financing that allows individuals to borrow and lend money without the use of an official financial institution as an intermediary. In a P2P lending scenario, loans are provided through online platforms that match borrowers with lenders. This financial model is fundamentally different from traditional lending, which typically involves banks or credit unions acting as intermediaries.

The operational flow of P2P lending typically involves a borrower submitting a loan request on a P2P platform. This request is then analyzed and, if approved, matched with potential lenders. The platform may cap the loan amount to manage risk, and both principal and interest repayments are handled through the platform. Lenders can be individual private investors or institutional investors, with loans capped at INR 50 Lakhs per lender and INR 10 Lakhs per borrower.

How do Investors Leverage P2P Lending Platforms?

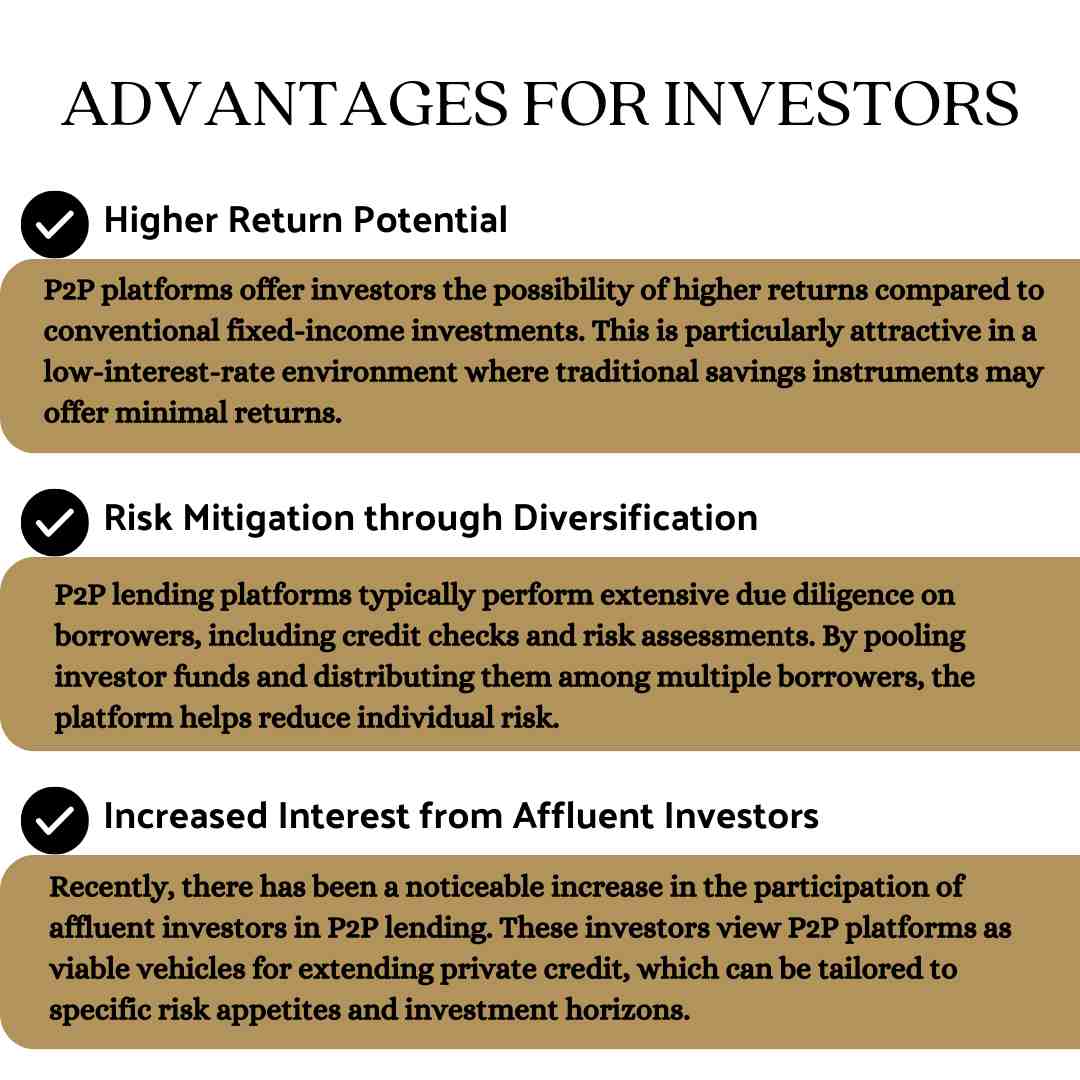

For investors, P2P lending offers a novel way to diversify their investment portfolios with the potential for higher returns compared to traditional investment avenues like fixed deposits or bonds. However, as with any investment, P2P lending carries risks, and investors must carefully consider these before committing their funds.

Despite these benefits, investors need to recognize the inherent risks associated with P2P lending. The lack of traditional safeguards such as insurance on deposits or government backing means that investors could potentially lose their capital if borrowers default on their loans.

Regulatory Framework for P2P Lending in India

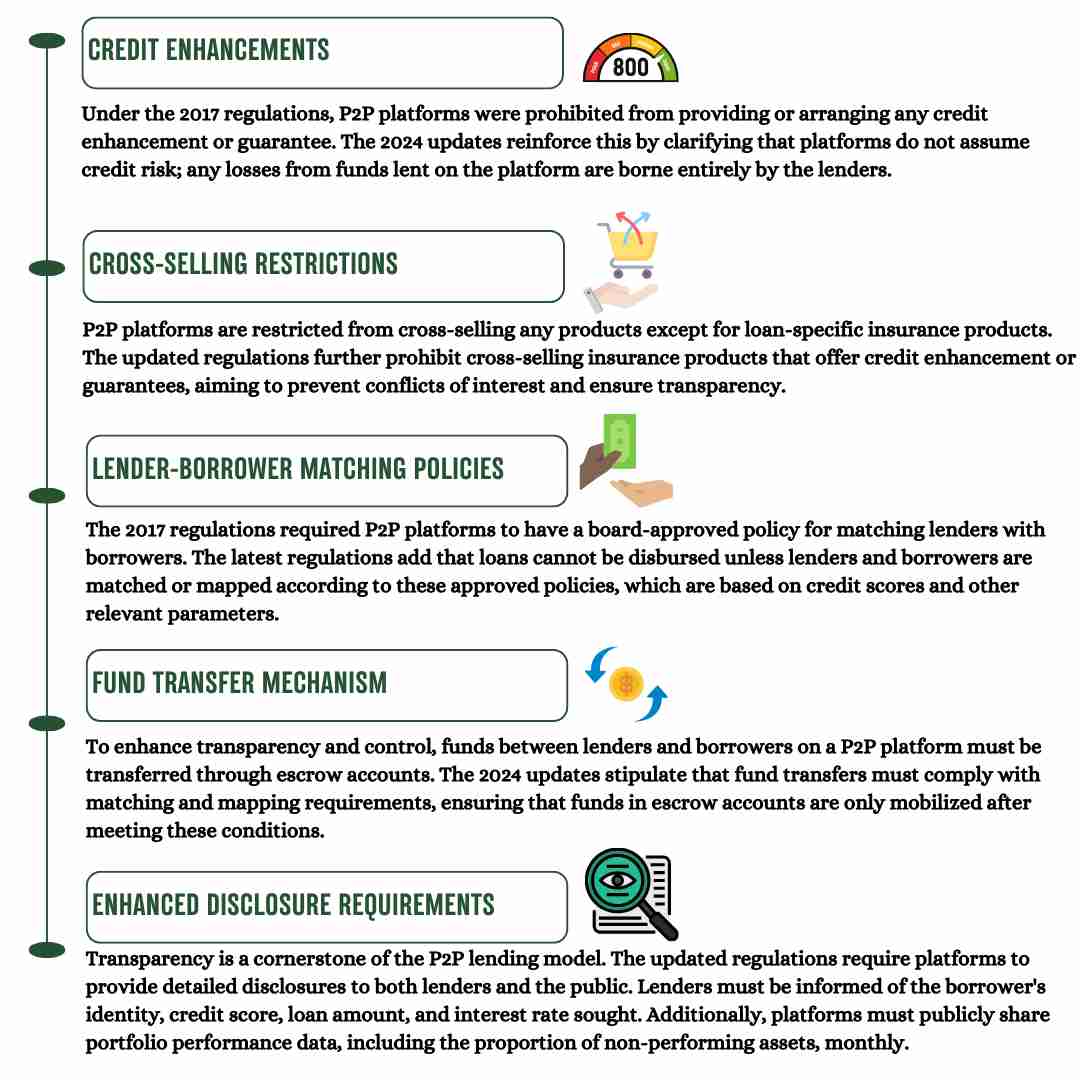

The rise of P2P lending platforms has not gone unnoticed by regulatory authorities in India. The Reserve Bank of India (RBI) regulates these platforms to ensure that they operate within a structured and secure framework. Over the years, the RBI has introduced various regulations to tighten the operational guidelines of P2P lending platforms, ensuring they align with broader financial stability goals.

Key Regulatory Aspects and Changes (August 2024):

What do Existing and Potential Investors Need to Know?

Given the evolving landscape of P2P lending in India, both existing and potential investors must be well-informed before engaging with these platforms. While the potential for higher returns is attractive, it is equally important to consider the risks and challenges associated with this investment option.

Considerations for Investors:

1. Risk Awareness: Investors must understand that they bear the full risk associated with borrower defaults. Unlike traditional banking products, P2P loans are not backed by government insurance or deposit guarantees. Therefore, the possibility of losing the invested capital in case of defaults is a significant risk.

2. Liquidity Concerns: P2P loans typically lack secondary market options, meaning investors must hold their positions until the loans are fully repaid. This lack of liquidity can be a drawback for investors who may need quick access to their funds.

3. Return Potential: While the potential for higher returns exists, these returns are directly tied to the level of risk involved. Investors should carefully assess the creditworthiness of borrowers and the terms of the loans before committing funds.

4. Transparency: The regulatory emphasis on enhanced disclosure practices aims to provide clearer insights into the operations of P2P platforms. Investors should take advantage of this transparency to make informed decisions, paying close attention to the platform's performance data and risk management strategies.

Whether you are a seasoned investor or new to the world of P2P lending, conducting due diligence and staying updated with regulatory developments are essential steps to success in this exciting financial frontier.

The Power of Portfolio Management Services: A Wise Investment Choice

28th November 2023