What are the steps for claiming an income tax refund online when filing your ITR?

3rd July 2024 | Author : Centricity

Filing an Income Tax Return (ITR) and claiming a refund can seem a daunting task, yet it is necessary! To make the process of filing and claiming a refund easier, it is important to first have a clear understanding of the documents required and the process to be followed. Additionally, it is important to be aware of the deadlines, as the ITR must be filed and any refund requested within a certain timeframe.

This usually happens when the taxpayer's advance tax, self-assessment tax, and/or TDS/TCS deductions exceed their entire tax liability for the fiscal year. You can receive this tax refund by filing your income tax return (ITR). The ITR filing date is July 31, 2024 for fiscal year 2023-24 (AY 2024-25). If you are eligible for an income tax refund, here's how to apply.

Here’s a comprehensive guide to help you claim your income tax refund online.

How to Calculate an Income Tax Refund with an Example?

If you paid more taxes than were required, you can receive an income tax refund.

Income tax refund = Taxes paid – Total tax liability.

A refund can be claimed if the taxes paid (whether through Advance Tax, TDS, TCS, or Self-Assessment Tax) exceed the actual tax amount owed. Taxes will be recalculated and the refund application validated before a refund is issued.

What is the tax refund duration?

The time it takes to get an income tax refund is dependent on the Income Tax Department's internal processes. After you have e-verified your return, it typically takes between 7 and 120 days, with an average of 90 days.

The Income Tax Department developed a new refund processing system to allow for speedier refund processing, with a projected turnaround time of a few days rather than a few months.

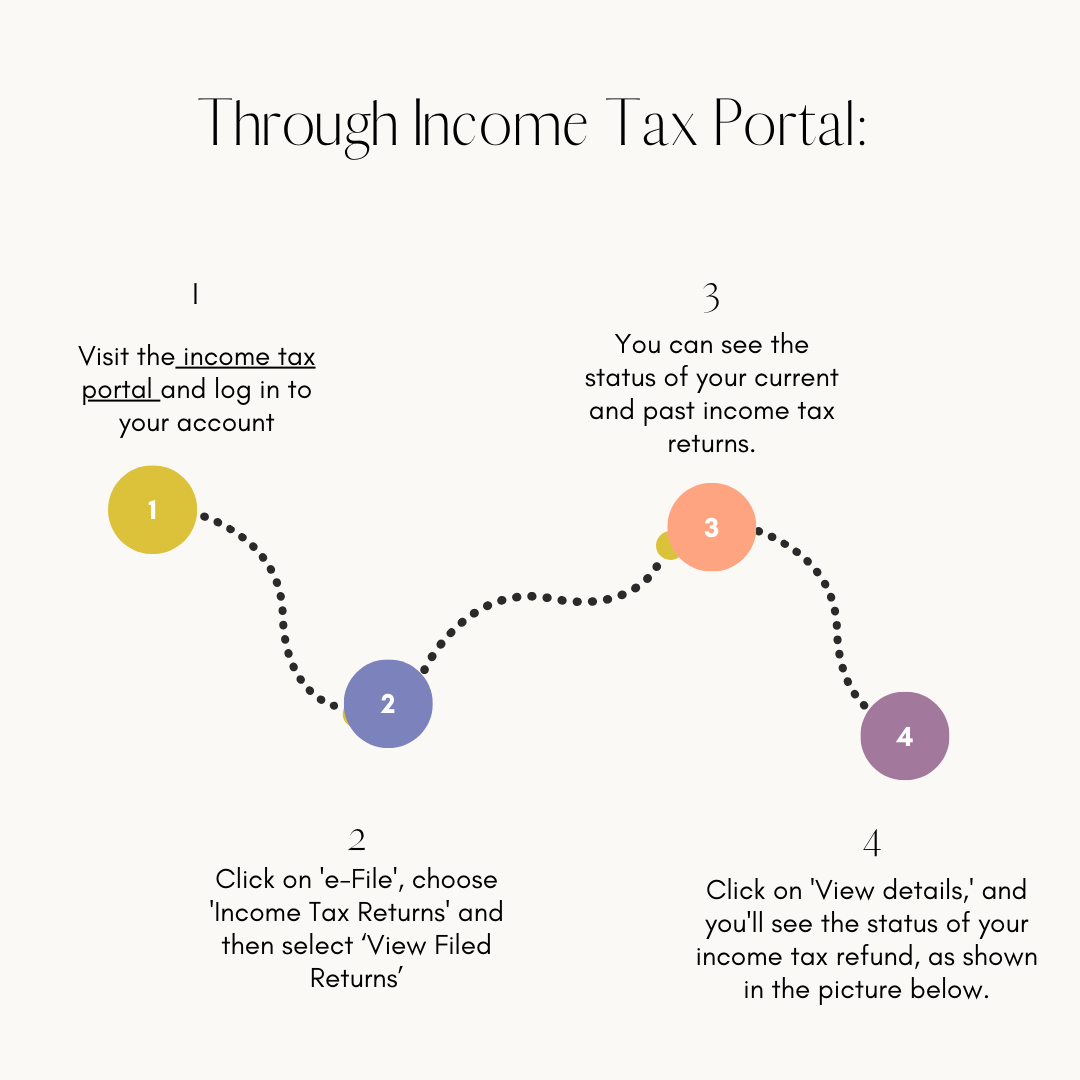

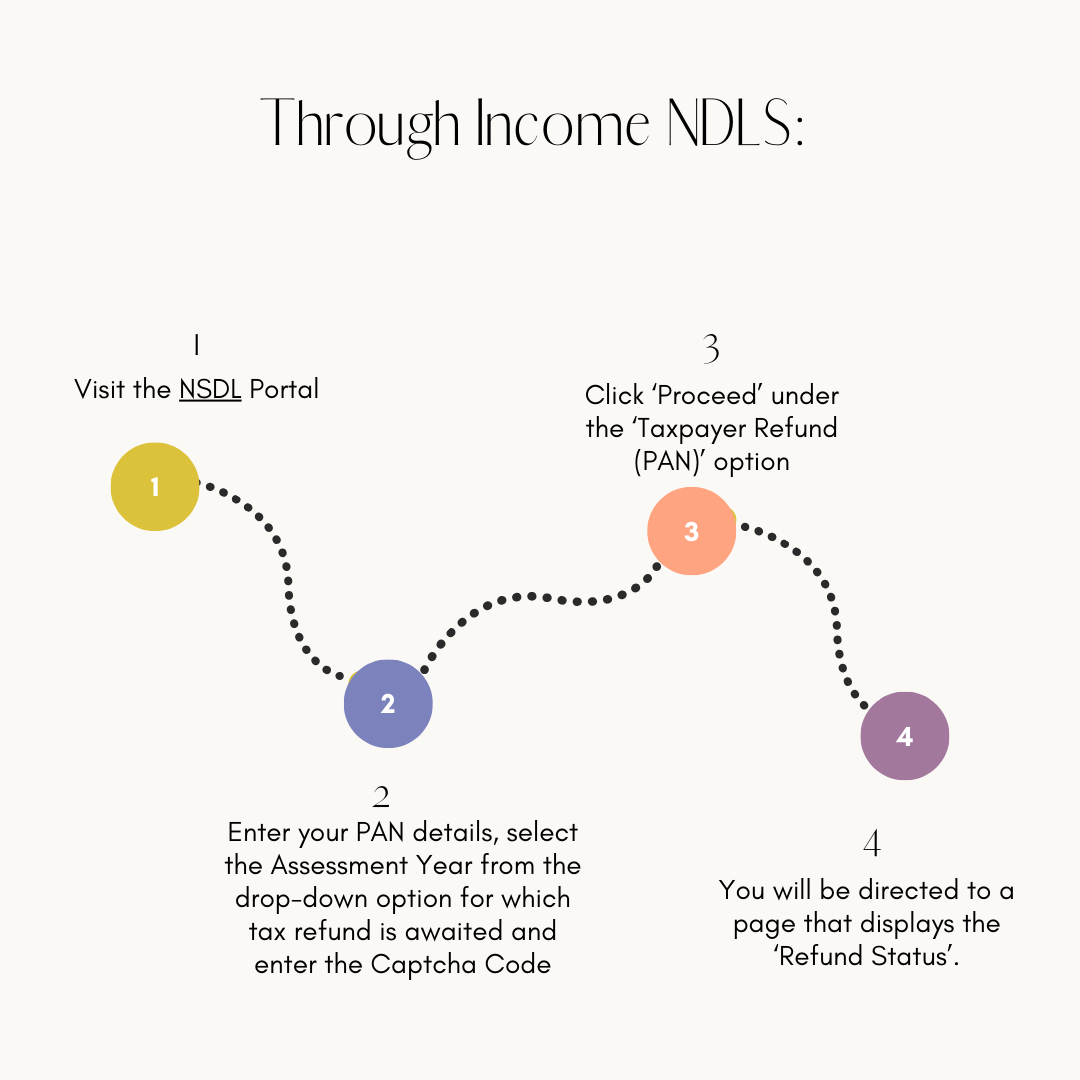

How to Check Your ITR Refund Status for AY 2024-25?

Can you fail to receive your refund?

If the IFSC code is invalid, the bank account is not pre-validated, or the name on the bank account does not match the PAN. You may also experience this if your account has been closed.

Disclaimer : The above information should not be relied upon for personal or financial decisions, and you should consult an appropriate financial professional for specific advice. The information presented under our newsletter and blogs is solely for informational purpose.

Avoid these common mistakes when filing your ITR!

12th March 2024